FedEx Cast Shadow On 1st Quarter Earnings Season

The institutions like what FedEx (NYSE: FDX) is delivering and have been buying the stock. Their purchases coincided with a bottom in price action that has the stock poised to move higher. The net of activity in the 1st 10 weeks of Q1 is worth 2.25% of the total shares and puts the institutional ownership at 77.75% and growing. Add in positive sentiment among the analysts and the stage is set for higher share prices, the question is how high will they go?

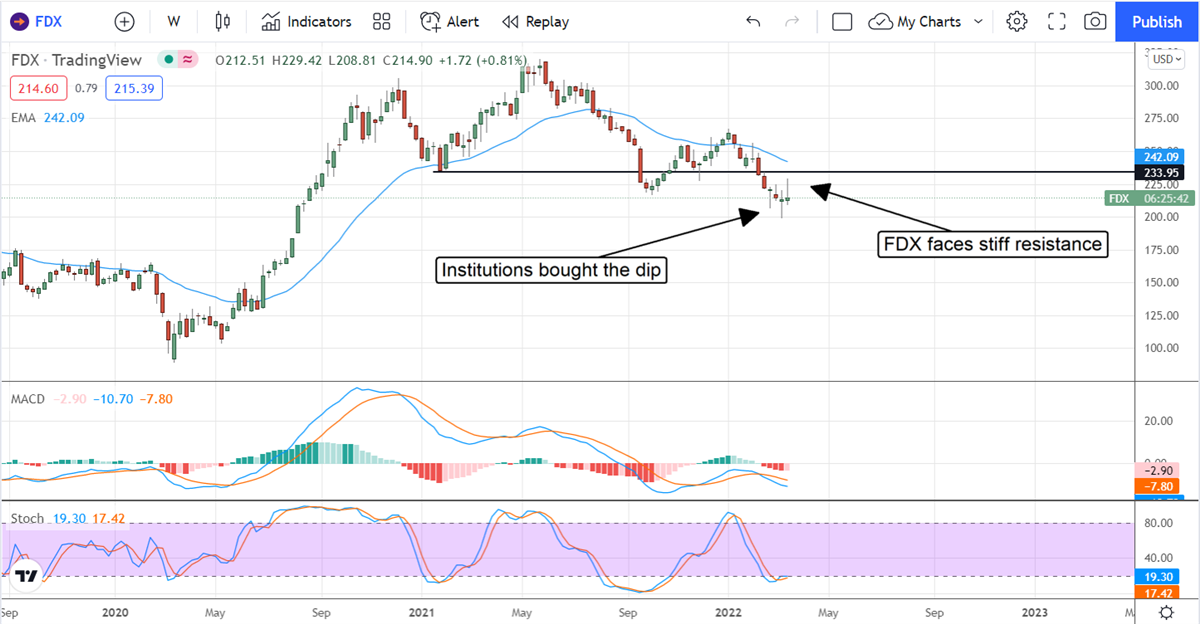

The analyst's consensus price target of $308.50 is 36% above the recent price action and a good place to start. That target puts the stock up near the all-time high but there are some hurdles to be aware of. First, the analyst's consensus price target is down from a peak set late in 2021 and now slightly below its level last year at this time. In our view, the consensus target could fall further and would be a weight on price action. Second, there is a 9-month downtrend in place and price action is below some key levels. If the stock cannot get above resistance in the range of $234 to $242 we see the stock moving sideways at current levels if not extending the downtrend to new lows.

FedEx Foreshadows Tough Times In Q1

FedEx had a good quarter but we have a situation in which both revenue and earnings could have been better if not for COVID-19, labor shortages, and the rising cost of shipping. Oddly, the rising cost of shipping is a two-edged sword for FedEx because it is boosting revenue for self-carried cargo while also cutting into the bottom line when they have to outsource freight capacity. This will be a problem later, too, when shipping costs retreat as they’ve been forecast to do because margins will widen but revenue per item will fall.

Regardless, the company reported $26.6 billion in net revenue for a gain of 9.8% over last year. The revenue beat the consensus by 100 basis points which is good but only marginally so because most of the growth is priced into the market. Moving down, the company was able to widen its margins as expected but less than predicted by the analysts. The operating margin improved to 6.2% from 4.9% but fell short of consensus due to higher labor costs, lost revenue to labor shortages, and higher shipping costs. On the bottom line, the adjusted $4.59 is up strongly from last year but fell short of expectations which is what will ultimately drive the price action.

Turning to the guidance, the company raised its targets for full-year earnings to $18.60 to $19.60 per share which falls short of the consensus by a dollar. The takeaway from the analyst's chatter is the company is still a Buy because of its historically low valuation but the value of the company is being reset due to tighter than expected margin and expected margin in the Q1 and Q2 periods of calendar 2022. This could keep investors out of the stock and share prices well below $300.

The Technical Outlook: Don’t Expect A Big Bounce From FedEx

Shares of FedEx have put in a bottom and are rebounding but we don’t expect big things from the move. Not only is there serious technical resistance to share prices but price action is retreating from those levels in the wake of the FQ3 results. In our view, this stock is range bound and could easily head back to $200 before it moves back above $235.

Companies in This Article:

About Thomas Hughes

tmhughes.writeon@gmail.com

Experience

Thomas Hughes has been a contributing writer for InsiderTrades.com since 2019.

Areas of Expertise

Technical analysis, the S&P 500; retail, consumer, consumer staples, dividends, high-yield, small caps, technology, economic data, oil, cryptocurrencies

Education

Associate of Arts in Culinary Technology

Past Experience

Market watcher, trader and investor for numerous websites. Founded Passive Market Intelligence LLC to provide market research insights.