The Bottom Is In For Newell Brands

After correcting more than 30% over the course of several quarters it looks like the bottom is in for Newell Brands (NASDAQ: NWL). Not only did the company exceed its quarterly estimates but it also has strong institutional support. The institutions have been purchasing this stock like made, buying $0.84 billion or 8.6% of the market cap over the last 12 months with a large portion of that done since the 1st of the year.

On a to-date basis, the Institutions have purchased about 2.3% of the market cap in 2022 and buying is broad-based and rising. One of the more notable recent purchasers of the stock is JPMorgan Chase which added 11% to its holdings bringing the total stake to 5.2%. That’s quite a vote of confidence in our opinion. The only reason for the institutions to buy this stock en masse is that they, collectively, think the stock is going higher and we agree.

Newell Brands Beats, Moves Higher On Margin Outlook

Newell Brands, the owner of Rubbermaid, Calphalon, and other popular household brands, had a decent quarter despite ongoing headwinds throughout the global economy. The company reported $2.81 billion in revenue for a gain of 4.3% over last year with the strength supported by demand and price increases. The revenue beat the consensus estimate by 600 basis points as well, and the strength was able to carry through to the bottom line. Core sales rose by 5.8% with 6 of the 8 operating units and all regions showing an improvement over last year. Improvements are also being driven by internal efforts to rationalize the business.

Moving on to the income, the gross and operating margins contracted versus last as input, shipping, and labor cost increases more than offset internal improvement and pricing efforts. The good news is that the adjusted operating margin contracted less than expected and results in outperformance on the bottom line. The GAAP EPS of $0.22 reflects the impact of one-off non-cash impairments but the $0.42 beat the consensus by $0.10 and margin gains are expected in the coming year.

Looking forward, the company is expecting $9.93 to $10.13 billion in net revenue versus the consensus of $10.49. That’s bad news but might be underestimating the supply chain improvement that other companies are forecasting for the back half of the year. On that bottom line, the company is expecting margin expansion of 50 to 80 basis points and for adjusted EPS of $$.185 to $1.93 versus the $1.87 consensus. That’s good news and compounded by the possibility that 1) the revenue forecast is light and 2) that 2nd-half supply chain improvement may drive additional margin gains.

Newell Brands Is A High Yield And Deep Value

Newell Brands is offering a deep discount to the broad market by trading at only 12.75X its earnings outlook with both revenue growth and margin improvement in the forecast. On top of this, it pays a very steady dividend worth more than 4% with shares trading near $22. In our view, this will add fuel to a rally once it gets started.

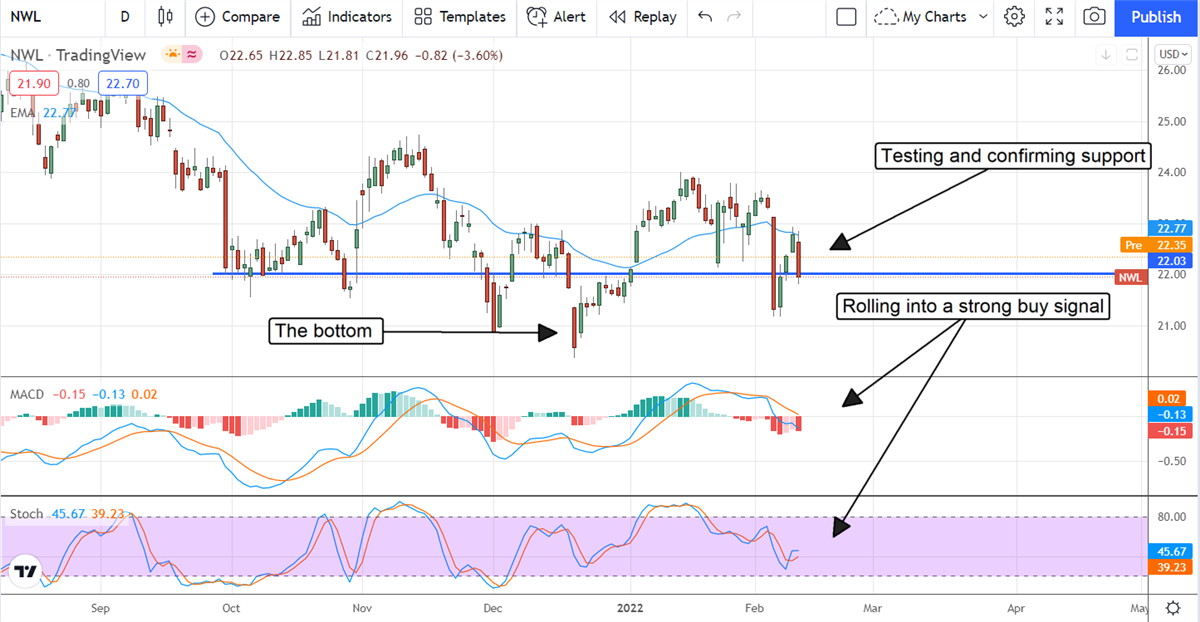

Looking at the charts, the rally may be starting now. The stock is up more than 1.0% in premarket trading and is confirming a bottom near the $21.25 level. The indicators have already reversed course so we are expecting to see some follow through on this move. Assuming the market does continue higher, we see this stock moving back to the $28 to $30 range and then possibly breaking out to new highs.

Companies in This Article:

About Thomas Hughes

tmhughes.writeon@gmail.com

Experience

Thomas Hughes has been a contributing writer for InsiderTrades.com since 2019.

Areas of Expertise

Technical analysis, the S&P 500; retail, consumer, consumer staples, dividends, high-yield, small caps, technology, economic data, oil, cryptocurrencies

Education

Associate of Arts in Culinary Technology

Past Experience

Market watcher, trader and investor for numerous websites. Founded Passive Market Intelligence LLC to provide market research insights.