Key Points

- Consumer staples stocks are beaten down and trading at significant support levels with growth in the forecast. '

- Values are below historical norms and yields are high, with some above 3% and others 5%.

- Analysts and institutions see these stocks moving higher and may provide a tailwind in 2024.

Consumer staples are beaten down. These stocks are down double-digits from their recent highs and trading significant support levels, suggesting the bottom is in. While near-term headwinds impact business and, more significantly, investor sentiment, they continue to grow and have a favorable outlook for the coming year. That might be why the institutions have been buying their stocks.

The Q3 earnings cycle produced mixed performance relative to the analysts' consensus, but results are solid across the board. These companies are growing, widening margins, and are expected to grow in Q4 and again in 2024. With shares trading near long-term lows, they offer technical buying points, higher-than-average yield, and deep value relative to their historical norms.

Lamb Weston (NYSE: LW), among the most highly-valued in the group, has fallen to 15X earnings, while PepsiCo (NASDAQ: PEP), the sector leader and best-in-breed, is down to about 21X earnings compared to the recent range of 25X to 30X. Kraft Heinz (NASDAQ: KHC) and Conagra Brands (NYSE: CAG), the best value-to-yield combinations in the sector, trade near 10X earnings while paying reliable 5% dividend yields.

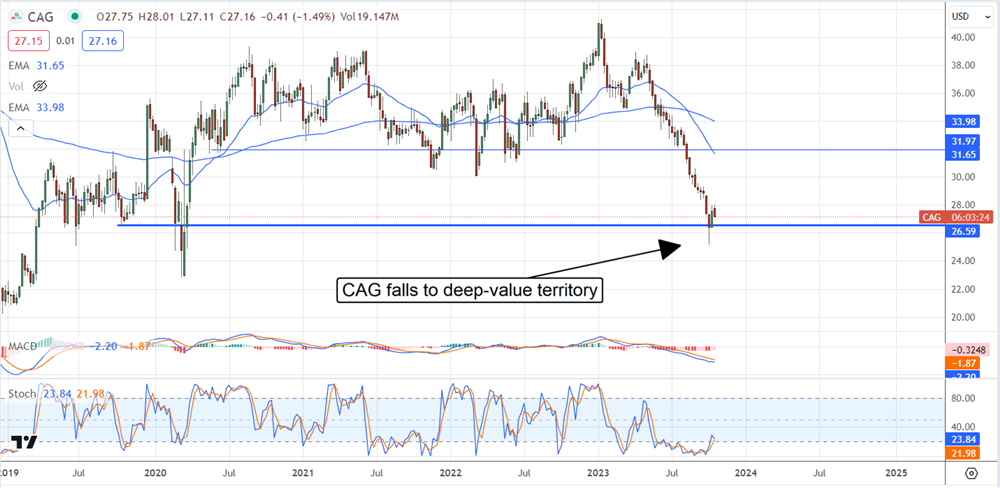

Conagra Brands: Packaged Foods are on Sale

Conagra Brands shares are down 50% from their highs and trading at the cheapest levels since the pandemic began. The business is slowing compared to the pandemic peak but stabilized well above the 2019 levels, suggesting value in more ways than 1.

This is the only company in this grouping expected to post negative results in Q4, but the low bar set by analysts offset this. Conagra, like the others, demonstrated margin power in the face of sluggish sales, which are expected to return to growth next year. Notably, a company director made a large purchase in Q4, coincident with bottoming action in the market, and institutional activity has shifted in favor of the bulls. Institutions sold in Q3, aiding the downdraft, but began to buy on balance in early Q4.

Lamb Weston for Robust Growth

Lamb Weston is the strongest performer regarding earnings and revenue growth, with high-double-digits posted for Q3. The strength is expected to persist into Q4, and 2024 also looks strong, including margin expansion. This is 1 of the lower-yielding stocks in the group, but the ultra-low payout ratio and outlook for sustained dividend growth offset the low yield. The takeaway is that the yield and payout are low now but won’t stay that way long, driving a price-multiple expansion over the coming years. A director of this company also bought stock in Q4; institutional activity was net-bullish in Q3 and the first weeks of Q4.

PepsiCo: The Best in Breed

PepsiCo is the best in breed among consumer staples. The diversified, global business model sustains mid-single-digit growth and pays a solid dividend. The payout is worth about 3.15% for this Dividend King and is still growing. The company pays 65% of earnings and increases distributions at a mid-single-digit pace that aligns with the EPS outlook. Institutions have bought this stock on balance for 4 consecutive quarters; analysts see the stock rising about 15% at the midpoint. The price action may consolidate at current levels before moving higher, but support is evident above critical levels in alignment with the long-term uptrend.

General Mills Pricing Power Drives Results

General Mills (NYSE: GIS) had a mixed 3rd quarter, but the top and bottom lines outperformed expectations due to the company’s pricing power. The analysts expect Q4 results to be solid and for growth to persist in 2024. The stock trades at a low 13X earnings compared to nearly 20X last year, yielding 3.75% with a positive outlook for distribution growth. Analysts rate the stock at Hold with a consensus target roughly 20% above the recent lows. Institutions were selling in Q3, but the balance of activity shifted to buying in Q4.

Kraft Heinz Slowly Builds Value

Kraft Heinz had a mixed Q3 relative to the analysts' consensus but grew on the top and bottom lines. The analysts have lowered their targets for Q4 and 2024, but both consensus sets expect top and bottom-line growth. That’s good news because it will help bring the payout ratio down to about 50% and bring the company closer to resuming distribution increases.

The analysts have a slim expectation for a distribution increase in 2024 and the expectation firms for 2025. Regardless of when distribution increases resume, it will catalyze higher share prices. Institutions have been buying this stock on balance for 7 consecutive quarters.

Companies in This Article:

About Thomas Hughes

tmhughes.writeon@gmail.com

Experience

Thomas Hughes has been a contributing writer for InsiderTrades.com since 2019.

Areas of Expertise

Technical analysis, the S&P 500; retail, consumer, consumer staples, dividends, high-yield, small caps, technology, economic data, oil, cryptocurrencies

Education

Associate of Arts in Culinary Technology

Past Experience

Market watcher, trader and investor for numerous websites. Founded Passive Market Intelligence LLC to provide market research insights.