Key Points

- Grocery Outlet's stock price decline may end with insiders and institutional buying picking up in Q1.

- A reorganization and right-sizing are underway that should set it for better profitability and sustainable growth.

- Cash flow and balance sheet health allow this company to buy back shares and reduce its share count.

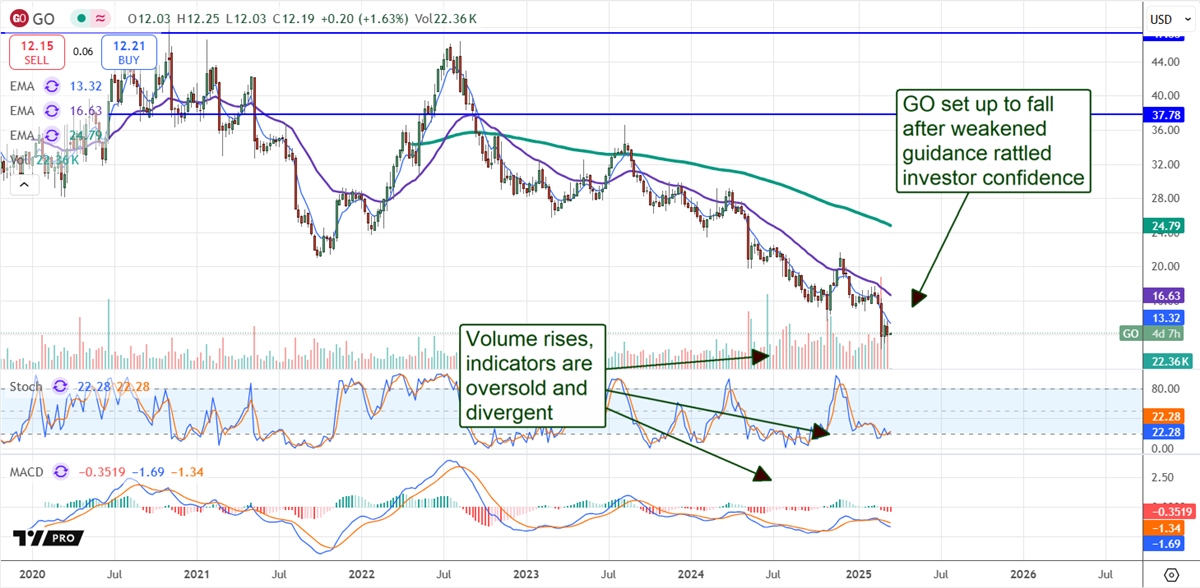

Grocery Outlet’s (NASDAQ: GO) share price has gone nowhere but lower for more than two years, but the downtrend may be over. Insider activity reverted to buying from selling in Q4 2024 and ramped to a multi-year high in Q1 2025. Buyers, including the CFO and two directors, netted $2.2 million in shares for the group, bringing their stake to about 3.8%. Granted, the CFO's purchases are tied to his recent hiring, but the directors are long-standing board members who already had skin in the game.

Institutional activity is a more telling indicator of this stock price's long-term price direction. Institutions are also buying and providing a much stronger tailwind for the market. Institutions own more than 90% of the stock and tend to buy on balance. Recent activity includes selling in Q3 of 2024 but reverting to buying in Q4 and ramping up in Q1 of 2025. The Q1 2025 activity is a multiyear high that netted more than 4% of the market cap, with shares near mid-March lows.

The analysts have created a headwind with their revisions, but even so, their sentiment and data trends suggest this stock is at its floor, if not deeply undervalued. The consensus target is down 50% year-over-year and falling in the wake of CQ4 2024 earrings results but still offers a solid 25% upside, with most of the fresh targets aligning or slightly below it. Morgan Stanley set the low price target of $10, aligning with the $11 and $12 targets set by Goldman Sachs and Deutsche Bank, indicating the potential for a price floor near recent trading levels.

Grocery Outlet Slows the Pace of Growth to Sustainable Levels

Grocery Outlet had a solid year in 2024 with store expansion and top and bottom line growth but struggled to match analysts' expectations and issued weaker-than-expected guidance for 2025. The critical takeaways are that this company is in a transition year, recently appointed a new CFO and CEO, and is realigning its growth targets with more sustainable levels.

The forecast for 2025 is weaker than expected, but it still expects a solid double-digit gain supported by comparable organic store growth and a rising store count. Growth is expected to top industry averages and be compounded by margin improvement. Reducing staff spooked the market but aligned with the right-sizing strategy, aiding the long-term margin, scalability, and profitability.

At the end of F2024, the balance sheet highlights reflect the impact of restructuring and growth efforts, including a reduction in cash and increased debt. However, the cash draw is offset by increased assets, equity is flat, and leverage is low, leaving it in a healthy position to continue its plans. Those include a modest capital return program consisting entirely of share repurchases. Share buybacks reduced the count by more than 1.2% in 2024 and are expected to continue reducing the count in 2025.

Short Interest Is High But Trending Lower for Grocery Outlet

The short interest in Grocery Outlook remains high, above 10%, and is weighing on the market. However, the short interest is trending lower over time and, even at this level, provides sufficient fuel for a short-covering rally or even a squeeze provided a bullish catalyst emerges. That may come over the next quarter or two as right-sizing efforts and the new management team gain traction.

The technical forecast for Grocery Outlet stock is sketchy. There are signs of bottoming, including oversold and divergent indicators and rising trading volume, but no clear bottom has formed yet. The latest activity looks like a Bearish Flag pattern, suggesting even lower prices will come. The market could move below $10 and possibly as low as $8 in this scenario, where it would present a deep value relative to its forward outlook. The company is expected to grow earnings at a double-digit pace and fall below 5x its 2030 consensus target.

Companies in This Article:

About Thomas Hughes

tmhughes.writeon@gmail.com

Experience

Thomas Hughes has been a contributing writer for InsiderTrades.com since 2019.

Areas of Expertise

Technical analysis, the S&P 500; retail, consumer, consumer staples, dividends, high-yield, small caps, technology, economic data, oil, cryptocurrencies

Education

Associate of Arts in Culinary Technology

Past Experience

Market watcher, trader and investor for numerous websites. Founded Passive Market Intelligence LLC to provide market research insights.