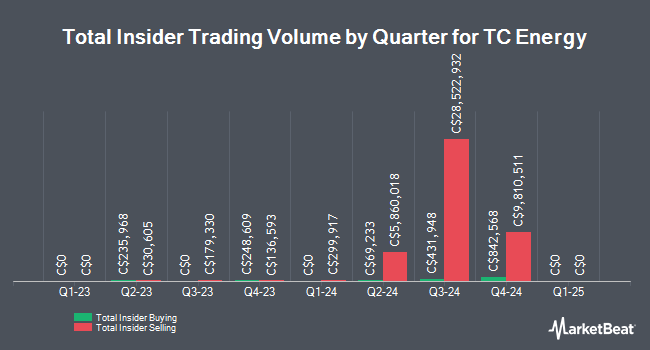

TC Energy Co. (TSE:TRP - Get Free Report) (NYSE:TRP) Director Lindsay Mackay sold 3,520 shares of TC Energy stock in a transaction on Monday, November 18th. The shares were sold at an average price of C$70.00, for a total transaction of C$246,400.00.

TC Energy Co. (TSE:TRP - Get Free Report) (NYSE:TRP) Director Lindsay Mackay sold 3,520 shares of TC Energy stock in a transaction on Monday, November 18th. The shares were sold at an average price of C$70.00, for a total transaction of C$246,400.00.

TC Energy Price Performance

Shares of TSE TRP opened at C$69.60 on Wednesday. The firm has a market capitalization of C$72.38 billion, a P/E ratio of 21.03, a PEG ratio of 1.69 and a beta of 0.82. TC Energy Co. has a one year low of C$43.83 and a one year high of C$70.24. The company's fifty day moving average is C$64.60 and its two-hundred day moving average is C$58.62. The company has a debt-to-equity ratio of 160.84, a quick ratio of 0.40 and a current ratio of 0.76.

TC Energy (TSE:TRP - Get Free Report) (NYSE:TRP) last issued its earnings results on Thursday, November 7th. The company reported C$1.03 EPS for the quarter, topping the consensus estimate of C$0.97 by C$0.06. The company had revenue of C$4.08 billion for the quarter, compared to analyst estimates of C$3.90 billion. TC Energy had a net margin of 21.38% and a return on equity of 10.68%. Analysts forecast that TC Energy Co. will post 3.5490515 EPS for the current fiscal year.

TC Energy Increases Dividend

Election warning coming true…

From Porter & Company | Ad

If you missed it, my emergency election broadcast is now available - watch it before it's too late.

Click here to watch it now.

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, January 31st. Investors of record on Tuesday, December 31st will be given a $1.113 dividend. The ex-dividend date is Tuesday, December 31st. This is a positive change from TC Energy's previous quarterly dividend of $0.96. This represents a $4.45 annualized dividend and a dividend yield of 6.40%. TC Energy's payout ratio is currently 116.01%.

Wall Street Analyst Weigh In

A number of equities analysts have recently commented on the stock. Veritas raised shares of TC Energy to a "strong sell" rating in a report on Tuesday, October 8th. ATB Capital lifted their target price on shares of TC Energy from C$64.00 to C$65.00 in a report on Friday, November 8th. UBS Group raised shares of TC Energy from a "hold" rating to a "strong-buy" rating in a report on Monday, September 30th. Barclays lifted their target price on shares of TC Energy from C$66.00 to C$67.00 in a report on Monday, October 21st. Finally, Royal Bank of Canada lifted their price objective on shares of TC Energy from C$67.00 to C$71.00 in a research report on Friday, November 8th. Two equities research analysts have rated the stock with a sell rating, five have given a hold rating, six have assigned a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Hold" and an average price target of C$67.62.

View Our Latest Stock Report on TRP

About TC Energy

(

Get Free Report)

TC Energy Corporation operates as an energy infrastructure company in North America. It operates through five segments: Canadian Natural Gas Pipelines; U.S. Natural Gas Pipelines; Mexico Natural Gas Pipelines; Liquids Pipelines; and Power and Energy Solutions. The company builds and operates a network of 93,600 kilometers of natural gas pipelines, which transports natural gas from supply basins to local distribution companies, power generation plants, industrial facilities, interconnecting pipelines, LNG export terminals, and other businesses.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].