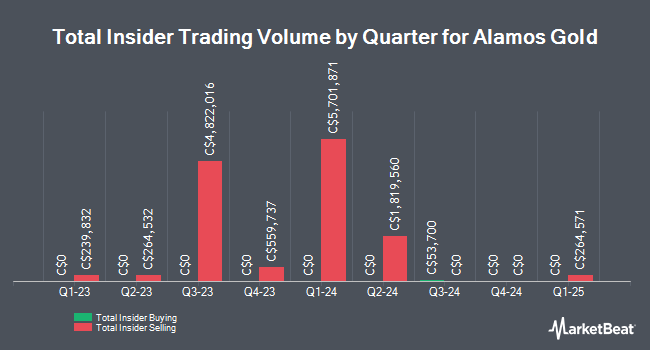

Alamos Gold Inc. (TSE:AGI - Get Free Report) (NYSE:AGI) Director David Alexander Fleck bought 2,000 shares of the business's stock in a transaction that occurred on Wednesday, December 18th. The stock was bought at an average price of C$26.85 per share, with a total value of C$53,700.00.

Alamos Gold Inc. (TSE:AGI - Get Free Report) (NYSE:AGI) Director David Alexander Fleck bought 2,000 shares of the business's stock in a transaction that occurred on Wednesday, December 18th. The stock was bought at an average price of C$26.85 per share, with a total value of C$53,700.00.

Alamos Gold Stock Performance

Shares of TSE:AGI opened at C$26.06 on Thursday. The company has a current ratio of 3.04, a quick ratio of 1.06 and a debt-to-equity ratio of 0.04. The company has a 50-day moving average price of C$27.10 and a 200-day moving average price of C$25.23. The company has a market cap of C$10.94 billion, a price-to-earnings ratio of 38.32, a price-to-earnings-growth ratio of -2.10 and a beta of 1.10. Alamos Gold Inc. has a 12 month low of C$15.27 and a 12 month high of C$29.66.

Alamos Gold (TSE:AGI - Get Free Report) (NYSE:AGI) last released its quarterly earnings results on Wednesday, November 6th. The company reported C$0.26 EPS for the quarter, missing analysts' consensus estimates of C$0.30 by C($0.04). The business had revenue of C$492.35 million for the quarter. Alamos Gold had a net margin of 17.72% and a return on equity of 6.72%. As a group, equities analysts anticipate that Alamos Gold Inc. will post 1.4774775 EPS for the current year.

Wall Street Analysts Forecast Growth

WARNING: “Buffett Indicator” flashing for first time in 50 years

From Behind the Markets | Ad

Warren Buffett has sold a staggering $97 billion worth of stocks this year...

But why?

Our research indicates the Oracle of Omaha is quietly preparing for a historic market crash.

His most reliable crash indicator - the "Buffett indicator" - just flashed red for the first time in 25 years.

Take these 4 steps today to protect your retirement NOW

A number of equities analysts have recently issued reports on AGI shares. CIBC upped their price objective on Alamos Gold from C$38.00 to C$40.00 in a report on Monday, December 2nd. National Bank Financial raised Alamos Gold from a "hold" rating to a "strong-buy" rating in a research note on Monday, December 2nd. BMO Capital Markets lifted their price target on shares of Alamos Gold from C$27.00 to C$31.00 and gave the stock an "outperform" rating in a research note on Monday, September 16th. Finally, National Bankshares raised shares of Alamos Gold from a "sector perform" rating to an "outperform" rating and set a C$35.00 price objective for the company in a research note on Tuesday, December 3rd. One analyst has rated the stock with a hold rating, seven have issued a buy rating and two have assigned a strong buy rating to the stock. According to data from MarketBeat, the stock presently has an average rating of "Buy" and an average price target of C$26.50.

Check Out Our Latest Stock Analysis on AGI

Alamos Gold Company Profile

(

Get Free Report)

Alamos Gold Inc engages in the acquisition, exploration, development, and extraction of precious metals in Canada and Mexico. The company primarily explores for gold deposits. It holds 100% interest in the Young-Davidson mine and Island Gold mine located in the Ontario, Canada; Mulatos mine located in the Sonora, Mexico; and Lynn Lake project situated in the Manitoba, Canada.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].