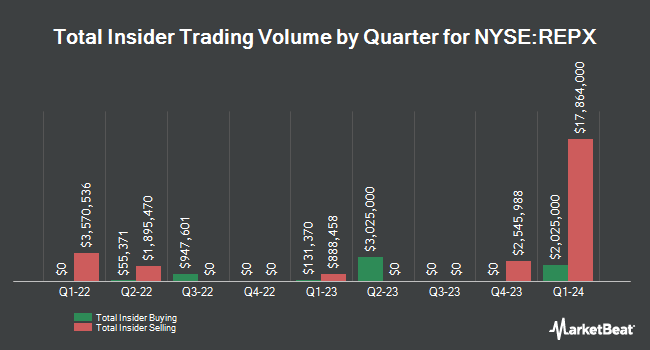

Riley Exploration Permian, Inc. (NYSE:REPX - Get Free Report) CFO Philip A. Riley bought 1,000 shares of Riley Exploration Permian stock in a transaction on Friday, April 11th. The stock was acquired at an average cost of $23.26 per share, for a total transaction of $23,260.00. Following the acquisition, the chief financial officer now owns 189,172 shares in the company, valued at approximately $4,400,140.72. This represents a 0.53 % increase in their position. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website.

Riley Exploration Permian, Inc. (NYSE:REPX - Get Free Report) CFO Philip A. Riley bought 1,000 shares of Riley Exploration Permian stock in a transaction on Friday, April 11th. The stock was acquired at an average cost of $23.26 per share, for a total transaction of $23,260.00. Following the acquisition, the chief financial officer now owns 189,172 shares in the company, valued at approximately $4,400,140.72. This represents a 0.53 % increase in their position. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website.

Riley Exploration Permian Price Performance

REPX stock opened at $23.95 on Tuesday. The stock has a market cap of $515.04 million, a price-to-earnings ratio of 4.25 and a beta of 1.47. The company has a debt-to-equity ratio of 0.53, a current ratio of 0.70 and a quick ratio of 0.64. The company has a 50 day simple moving average of $29.62 and a 200 day simple moving average of $31.03. Riley Exploration Permian, Inc. has a 1 year low of $21.98 and a 1 year high of $37.55.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of REPX. Vanguard Group Inc. grew its position in Riley Exploration Permian by 29.4% during the 4th quarter. Vanguard Group Inc. now owns 912,038 shares of the company's stock worth $29,112,000 after acquiring an additional 207,319 shares during the last quarter. Jackson Hole Capital Partners LLC boosted its stake in shares of Riley Exploration Permian by 1.2% during the fourth quarter. Jackson Hole Capital Partners LLC now owns 394,796 shares of the company's stock valued at $12,602,000 after purchasing an additional 4,788 shares in the last quarter. American Century Companies Inc. grew its holdings in shares of Riley Exploration Permian by 35.5% during the fourth quarter. American Century Companies Inc. now owns 385,341 shares of the company's stock worth $12,300,000 after purchasing an additional 100,891 shares during the last quarter. Dimensional Fund Advisors LP increased its stake in shares of Riley Exploration Permian by 50.2% in the fourth quarter. Dimensional Fund Advisors LP now owns 303,143 shares of the company's stock valued at $9,691,000 after buying an additional 101,309 shares during the period. Finally, First Eagle Investment Management LLC raised its holdings in Riley Exploration Permian by 2.2% in the 4th quarter. First Eagle Investment Management LLC now owns 287,048 shares of the company's stock valued at $9,163,000 after buying an additional 6,100 shares during the last quarter. 58.91% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Separately, Truist Financial raised their price objective on Riley Exploration Permian from $45.00 to $47.00 and gave the company a "buy" rating in a research note on Monday, January 13th.

Check Out Our Latest Stock Report on Riley Exploration Permian

About Riley Exploration Permian

(

Get Free Report)

Riley Exploration Permian, Inc, an independent oil and natural gas company, engages in the acquisition, exploration, development, and production of oil, natural gas, and natural gas liquids in Texas and New Mexico. The company's activities are primarily focused on the Northwest Shelf and Yeso trend of the Permian Basin.

Further Reading

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to contact@insidertrades.com.