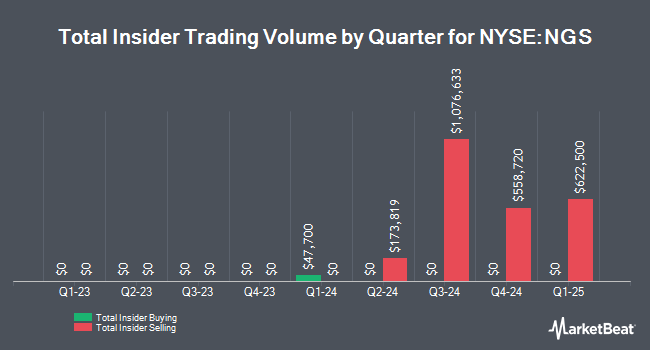

Natural Gas Services Group, Inc. (NYSE:NGS - Get Free Report) Director Stephen Charles Taylor sold 1,521 shares of the business's stock in a transaction that occurred on Wednesday, November 20th. The stock was sold at an average price of $26.00, for a total value of $39,546.00. Following the completion of the transaction, the director now directly owns 516,866 shares in the company, valued at $13,438,516. The trade was a 0.29 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink.

Natural Gas Services Group, Inc. (NYSE:NGS - Get Free Report) Director Stephen Charles Taylor sold 1,521 shares of the business's stock in a transaction that occurred on Wednesday, November 20th. The stock was sold at an average price of $26.00, for a total value of $39,546.00. Following the completion of the transaction, the director now directly owns 516,866 shares in the company, valued at $13,438,516. The trade was a 0.29 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink.

Stephen Charles Taylor also recently made the following trade(s):

- On Monday, November 18th, Stephen Charles Taylor sold 3,442 shares of Natural Gas Services Group stock. The stock was sold at an average price of $25.51, for a total value of $87,805.42.

- On Friday, November 15th, Stephen Charles Taylor sold 10,042 shares of Natural Gas Services Group stock. The shares were sold at an average price of $25.01, for a total value of $251,150.42.

- On Wednesday, November 13th, Stephen Charles Taylor sold 2,191 shares of Natural Gas Services Group stock. The shares were sold at an average price of $24.50, for a total transaction of $53,679.50.

- On Monday, November 11th, Stephen Charles Taylor sold 3,096 shares of Natural Gas Services Group stock. The stock was sold at an average price of $24.50, for a total transaction of $75,852.00.

- On Monday, August 26th, Stephen Charles Taylor sold 3,181 shares of Natural Gas Services Group stock. The shares were sold at an average price of $22.00, for a total value of $69,982.00.

Natural Gas Services Group Trading Up 2.1 %

Buffett's Oil Bet + This 22% Dividend Play

From Investors Alley | Ad

Warren Buffett has been quietly amassing a massive position in oil stocks.

But while Buffett's picks (Occidental and Chevron) pay modest dividends of 1.47% and 4%, we've found a way for regular investors to potentially earn a much bigger income stream from the energy boom.

Click here to get the full story >>

Shares of NGS stock traded up $0.58 during trading hours on Friday, reaching $27.81. The company had a trading volume of 61,799 shares, compared to its average volume of 66,815. The firm has a market cap of $346.90 million, a price-to-earnings ratio of 21.80 and a beta of 1.03. Natural Gas Services Group, Inc. has a 1-year low of $12.75 and a 1-year high of $28.14. The company has a 50 day moving average of $21.01 and a 200 day moving average of $20.71. The company has a debt-to-equity ratio of 0.65, a current ratio of 1.76 and a quick ratio of 1.16.

Institutional Inflows and Outflows

A number of institutional investors have recently bought and sold shares of NGS. Ancora Advisors LLC boosted its position in shares of Natural Gas Services Group by 163.7% during the first quarter. Ancora Advisors LLC now owns 83,830 shares of the oil and gas company's stock worth $1,629,000 after purchasing an additional 52,040 shares in the last quarter. Russell Investments Group Ltd. increased its holdings in shares of Natural Gas Services Group by 32.4% in the first quarter. Russell Investments Group Ltd. now owns 172,221 shares of the oil and gas company's stock worth $3,346,000 after acquiring an additional 42,099 shares in the last quarter. Assenagon Asset Management S.A. raised its position in shares of Natural Gas Services Group by 80.1% during the second quarter. Assenagon Asset Management S.A. now owns 91,427 shares of the oil and gas company's stock worth $1,840,000 after purchasing an additional 40,672 shares during the period. Bank of New York Mellon Corp bought a new position in shares of Natural Gas Services Group during the 2nd quarter valued at about $788,000. Finally, Marshall Wace LLP grew its position in shares of Natural Gas Services Group by 100.7% in the 2nd quarter. Marshall Wace LLP now owns 77,220 shares of the oil and gas company's stock valued at $1,554,000 after purchasing an additional 38,751 shares during the period. Institutional investors and hedge funds own 65.62% of the company's stock.

Analyst Upgrades and Downgrades

Several research firms recently issued reports on NGS. StockNews.com upgraded Natural Gas Services Group from a "sell" rating to a "hold" rating in a report on Wednesday. Raymond James began coverage on shares of Natural Gas Services Group in a research report on Wednesday, August 7th. They set a "strong-buy" rating and a $27.00 target price on the stock.

Get Our Latest Analysis on NGS

About Natural Gas Services Group

(

Get Free Report)

Natural Gas Services Group, Inc provides natural gas compression equipment and services to the energy industry in the United States. It engineers and fabricates, operates, rents, and maintains natural gas compressors for oil and natural gas production and plant facilities. It also designs, fabricates, and assembles compressor units for rental or sale; and designs, manufactures, and sells a line of reciprocating natural gas compressor frames, cylinders, and parts.

Further Reading

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].