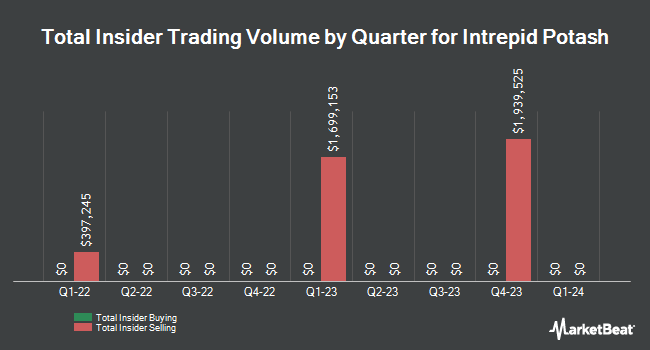

Intrepid Potash, Inc. (NYSE:IPI - Get Free Report) major shareholder Robert P. Jornayvaz III sold 3,557 shares of the firm's stock in a transaction dated Monday, December 16th. The shares were sold at an average price of $25.00, for a total transaction of $88,925.00. Following the sale, the insider now owns 129,230 shares of the company's stock, valued at approximately $3,230,750. This represents a 2.68 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this hyperlink. Large shareholders that own 10% or more of a company's shares are required to disclose their sales and purchases with the SEC.

Intrepid Potash, Inc. (NYSE:IPI - Get Free Report) major shareholder Robert P. Jornayvaz III sold 3,557 shares of the firm's stock in a transaction dated Monday, December 16th. The shares were sold at an average price of $25.00, for a total transaction of $88,925.00. Following the sale, the insider now owns 129,230 shares of the company's stock, valued at approximately $3,230,750. This represents a 2.68 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this hyperlink. Large shareholders that own 10% or more of a company's shares are required to disclose their sales and purchases with the SEC.

Intrepid Potash Stock Performance

IPI opened at $22.10 on Friday. The company's 50-day simple moving average is $25.75 and its two-hundred day simple moving average is $24.48. The stock has a market capitalization of $290.90 million, a P/E ratio of -6.60 and a beta of 2.21. Intrepid Potash, Inc. has a 52-week low of $17.52 and a 52-week high of $29.75.

Intrepid Potash (NYSE:IPI - Get Free Report) last issued its quarterly earnings data on Monday, November 4th. The basic materials company reported ($0.14) earnings per share for the quarter, missing analysts' consensus estimates of $0.11 by ($0.25). Intrepid Potash had a negative net margin of 16.86% and a negative return on equity of 1.32%. The company had revenue of $57.55 million for the quarter, compared to the consensus estimate of $42.57 million. During the same quarter last year, the company earned ($0.53) EPS. Research analysts forecast that Intrepid Potash, Inc. will post -0.17 EPS for the current fiscal year.

Institutional Trading of Intrepid Potash

URGENT: This Altcoin Opportunity Won’t Wait – Act Now

From Crypto Swap Profits | Ad

Crypto has officially entered the "banana zone" – that wild phase where prices can 1000x in days.

It happens like clockwork every 4 years, during the December to February window of a Bitcoin halving year.

This is where fortunes are made – often LITERALLY overnight.

>> Register for the Workshop Now

Several large investors have recently modified their holdings of the company. First Eagle Investment Management LLC lifted its holdings in Intrepid Potash by 25.1% in the second quarter. First Eagle Investment Management LLC now owns 602,770 shares of the basic materials company's stock valued at $14,123,000 after acquiring an additional 121,100 shares during the period. Glenorchy Capital Ltd increased its position in shares of Intrepid Potash by 95.7% during the 3rd quarter. Glenorchy Capital Ltd now owns 62,214 shares of the basic materials company's stock valued at $1,493,000 after purchasing an additional 30,425 shares during the last quarter. Pinnacle Associates Ltd. bought a new position in shares of Intrepid Potash in the 3rd quarter worth approximately $3,100,000. The Manufacturers Life Insurance Company purchased a new position in shares of Intrepid Potash in the third quarter worth approximately $602,000. Finally, Cubist Systematic Strategies LLC bought a new stake in Intrepid Potash during the second quarter valued at approximately $979,000. Institutional investors own 56.13% of the company's stock.

Analysts Set New Price Targets

A number of equities research analysts have recently commented on IPI shares. UBS Group increased their price target on shares of Intrepid Potash from $18.00 to $19.00 and gave the company a "sell" rating in a report on Tuesday, November 5th. StockNews.com raised Intrepid Potash from a "sell" rating to a "hold" rating in a report on Wednesday, November 6th.

Check Out Our Latest Research Report on Intrepid Potash

About Intrepid Potash

(

Get Free Report)

Intrepid Potash, Inc, together with its subsidiaries, engages in the extraction and production of the potash in the United States and internationally. It operates through three segments: Potash, Trio, and Oilfield Solutions. The company offers muriate of potash for various markets, such as agricultural market as a fertilizer input; the industrial market as a component in drilling and fracturing fluids for oil and gas wells, as well as an input to other industrial processes; and the animal feed market as a nutrient supplement.

See Also

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].