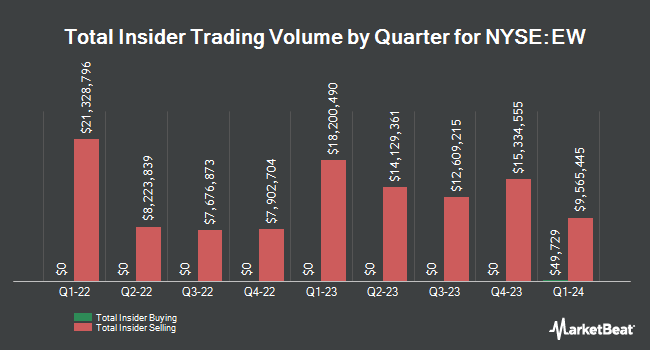

Edwards Lifesciences Co. (NYSE:EW - Get Free Report) VP Daniel J. Lippis sold 2,500 shares of the company's stock in a transaction dated Monday, December 16th. The shares were sold at an average price of $74.08, for a total transaction of $185,200.00. Following the transaction, the vice president now directly owns 23,189 shares of the company's stock, valued at approximately $1,717,841.12. This represents a 9.73 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this link.

Edwards Lifesciences Co. (NYSE:EW - Get Free Report) VP Daniel J. Lippis sold 2,500 shares of the company's stock in a transaction dated Monday, December 16th. The shares were sold at an average price of $74.08, for a total transaction of $185,200.00. Following the transaction, the vice president now directly owns 23,189 shares of the company's stock, valued at approximately $1,717,841.12. This represents a 9.73 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this link.

Edwards Lifesciences Stock Performance

Edwards Lifesciences stock opened at $73.91 on Tuesday. Edwards Lifesciences Co. has a 12-month low of $58.93 and a 12-month high of $96.12. The company has a debt-to-equity ratio of 0.06, a current ratio of 3.46 and a quick ratio of 2.89. The company has a market capitalization of $43.59 billion, a price-to-earnings ratio of 10.67, a price-to-earnings-growth ratio of 3.63 and a beta of 1.12. The firm's fifty day moving average price is $69.61 and its 200 day moving average price is $73.80.

URGENT: This Altcoin Opportunity Won’t Wait – Act Now

From Crypto Swap Profits | Ad

Crypto has officially entered the "banana zone" – that wild phase where prices can 1000x in days.

It happens like clockwork every 4 years, during the December to February window of a Bitcoin halving year.

This is where fortunes are made – often LITERALLY overnight.

>> Register for the Workshop Now

Edwards Lifesciences (NYSE:EW - Get Free Report) last announced its earnings results on Thursday, October 24th. The medical research company reported $0.67 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $0.67. Edwards Lifesciences had a return on equity of 20.76% and a net margin of 70.82%. The business had revenue of $1.35 billion for the quarter, compared to analyst estimates of $1.57 billion. During the same period in the previous year, the company earned $0.59 earnings per share. The company's revenue for the quarter was up 8.9% compared to the same quarter last year. On average, research analysts forecast that Edwards Lifesciences Co. will post 2.56 EPS for the current fiscal year.

Analyst Ratings Changes

EW has been the subject of several research analyst reports. Piper Sandler dropped their price target on shares of Edwards Lifesciences from $73.00 to $70.00 and set a "neutral" rating for the company in a research report on Friday, October 25th. Stifel Nicolaus upped their price objective on Edwards Lifesciences from $70.00 to $75.00 and gave the stock a "hold" rating in a report on Thursday, December 5th. Jefferies Financial Group lowered Edwards Lifesciences from a "buy" rating to a "hold" rating and cut their target price for the stock from $85.00 to $70.00 in a research report on Wednesday, September 18th. Robert W. Baird lowered their price target on Edwards Lifesciences from $73.00 to $68.00 and set a "neutral" rating for the company in a research report on Friday, October 25th. Finally, Citigroup raised their price objective on Edwards Lifesciences from $81.00 to $83.00 and gave the stock a "buy" rating in a report on Wednesday, December 11th. Sixteen analysts have rated the stock with a hold rating and eleven have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus target price of $79.40.

View Our Latest Research Report on Edwards Lifesciences

Hedge Funds Weigh In On Edwards Lifesciences

Institutional investors have recently made changes to their positions in the business. FSA Wealth Management LLC acquired a new stake in shares of Edwards Lifesciences during the third quarter worth approximately $30,000. Prospera Private Wealth LLC bought a new position in Edwards Lifesciences during the 3rd quarter valued at $32,000. Avior Wealth Management LLC grew its holdings in Edwards Lifesciences by 138.7% during the 3rd quarter. Avior Wealth Management LLC now owns 530 shares of the medical research company's stock worth $35,000 after acquiring an additional 308 shares in the last quarter. Peoples Bank KS acquired a new position in Edwards Lifesciences during the 3rd quarter worth $40,000. Finally, JFS Wealth Advisors LLC increased its position in shares of Edwards Lifesciences by 31.1% in the 3rd quarter. JFS Wealth Advisors LLC now owns 700 shares of the medical research company's stock worth $46,000 after purchasing an additional 166 shares during the last quarter. 79.46% of the stock is owned by institutional investors and hedge funds.

About Edwards Lifesciences

(

Get Free Report)

Edwards Lifesciences Corporation provides products and technologies for structural heart disease and critical care monitoring in the United States, Europe, Japan, and internationally. It offers transcatheter heart valve replacement products for the minimally invasive replacement of aortic heart valves under the Edwards SAPIEN family of valves system; and transcatheter heart valve repair and replacement products to treat mitral and tricuspid valve diseases under the PASCAL PRECISION and Cardioband names.

Further Reading

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].