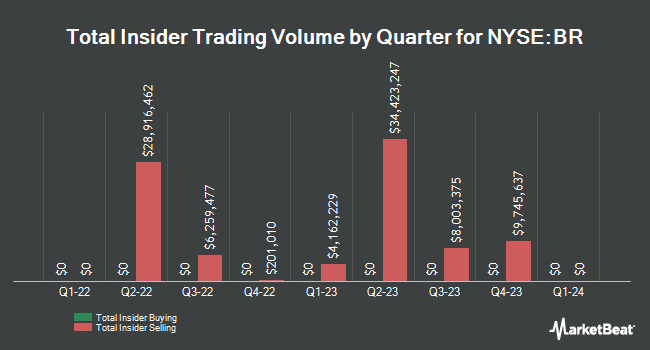

Broadridge Financial Solutions, Inc. (NYSE:BR - Get Free Report) VP Thomas P. Carey sold 15,710 shares of the firm's stock in a transaction that occurred on Tuesday, December 3rd. The shares were sold at an average price of $230.32, for a total value of $3,618,327.20. Following the completion of the sale, the vice president now directly owns 12,146 shares in the company, valued at approximately $2,797,466.72. The trade was a 56.40 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this link.

Broadridge Financial Solutions, Inc. (NYSE:BR - Get Free Report) VP Thomas P. Carey sold 15,710 shares of the firm's stock in a transaction that occurred on Tuesday, December 3rd. The shares were sold at an average price of $230.32, for a total value of $3,618,327.20. Following the completion of the sale, the vice president now directly owns 12,146 shares in the company, valued at approximately $2,797,466.72. The trade was a 56.40 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this link.

Broadridge Financial Solutions Stock Performance

NYSE BR opened at $232.86 on Thursday. Broadridge Financial Solutions, Inc. has a 1-year low of $188.30 and a 1-year high of $237.74. The company has a market cap of $27.22 billion, a PE ratio of 40.29 and a beta of 1.07. The company has a debt-to-equity ratio of 1.63, a current ratio of 1.39 and a quick ratio of 1.39. The stock's 50 day simple moving average is $220.97 and its 200-day simple moving average is $211.02.

Broadridge Financial Solutions (NYSE:BR - Get Free Report) last announced its quarterly earnings data on Tuesday, November 5th. The business services provider reported $1.00 EPS for the quarter, topping analysts' consensus estimates of $0.97 by $0.03. Broadridge Financial Solutions had a return on equity of 41.79% and a net margin of 10.57%. The firm had revenue of $1.42 billion for the quarter, compared to the consensus estimate of $1.48 billion. During the same quarter last year, the business posted $1.09 earnings per share. The firm's revenue was down .6% compared to the same quarter last year. As a group, equities research analysts anticipate that Broadridge Financial Solutions, Inc. will post 8.52 EPS for the current fiscal year.

Broadridge Financial Solutions Dividend Announcement

Did You See Trump’s Bombshell Exec. Order 001?

From Banyan Hill Publishing | Ad

Biden broke it... Now Trump is going to fix it.

Starting with "Exec. Order 001."

I put all the details together for you here — but please hurry.

The business also recently disclosed a quarterly dividend, which will be paid on Friday, January 3rd. Investors of record on Friday, December 13th will be given a dividend of $0.88 per share. The ex-dividend date is Friday, December 13th. This represents a $3.52 dividend on an annualized basis and a yield of 1.51%. Broadridge Financial Solutions's payout ratio is 60.90%.

Hedge Funds Weigh In On Broadridge Financial Solutions

Institutional investors have recently added to or reduced their stakes in the stock. Bogart Wealth LLC lifted its position in Broadridge Financial Solutions by 384.0% during the third quarter. Bogart Wealth LLC now owns 121 shares of the business services provider's stock worth $26,000 after buying an additional 96 shares in the last quarter. EdgeRock Capital LLC purchased a new stake in Broadridge Financial Solutions in the second quarter valued at $32,000. Rothschild Investment LLC purchased a new stake in Broadridge Financial Solutions in the second quarter valued at $32,000. True Wealth Design LLC raised its position in Broadridge Financial Solutions by 2,028.6% in the third quarter. True Wealth Design LLC now owns 149 shares of the business services provider's stock valued at $32,000 after purchasing an additional 142 shares during the period. Finally, Family Firm Inc. purchased a new stake in Broadridge Financial Solutions in the second quarter valued at $37,000. Hedge funds and other institutional investors own 90.03% of the company's stock.

Analyst Upgrades and Downgrades

Several analysts have commented on BR shares. Royal Bank of Canada reissued an "outperform" rating and issued a $246.00 price objective on shares of Broadridge Financial Solutions in a report on Wednesday, November 6th. Morgan Stanley raised their price objective on Broadridge Financial Solutions from $200.00 to $207.00 and gave the company an "equal weight" rating in a report on Wednesday, November 6th. JPMorgan Chase & Co. raised their target price on Broadridge Financial Solutions from $224.00 to $225.00 and gave the company a "neutral" rating in a research report on Tuesday, August 20th. UBS Group initiated coverage on Broadridge Financial Solutions in a research report on Thursday, November 21st. They issued a "neutral" rating and a $250.00 target price on the stock. Finally, StockNews.com downgraded Broadridge Financial Solutions from a "buy" rating to a "hold" rating in a research report on Saturday, November 9th. Five research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Hold" and a consensus price target of $222.43.

Check Out Our Latest Research Report on BR

Broadridge Financial Solutions Company Profile

(

Get Free Report)

Broadridge Financial Solutions, Inc provides investor communications and technology-driven solutions for the financial services industry. The company's Investor Communication Solutions segment processes and distributes proxy materials to investors in equity securities and mutual funds, as well as facilitates related vote processing services; and distributes regulatory reports, class action, and corporate action/reorganization event information, as well as tax reporting solutions.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].