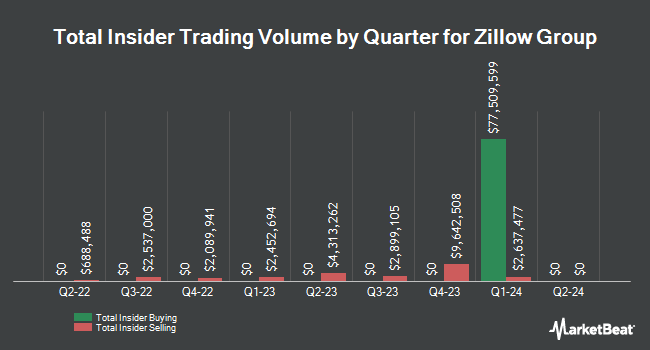

Zillow Group, Inc. (NASDAQ:ZG - Get Free Report) COO Jun Choo sold 10,000 shares of the company's stock in a transaction on Tuesday, November 19th. The shares were sold at an average price of $75.10, for a total value of $751,000.00. Following the completion of the transaction, the chief operating officer now owns 88,130 shares of the company's stock, valued at $6,618,563. The trade was a 10.19 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link.

Zillow Group, Inc. (NASDAQ:ZG - Get Free Report) COO Jun Choo sold 10,000 shares of the company's stock in a transaction on Tuesday, November 19th. The shares were sold at an average price of $75.10, for a total value of $751,000.00. Following the completion of the transaction, the chief operating officer now owns 88,130 shares of the company's stock, valued at $6,618,563. The trade was a 10.19 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link.

Zillow Group Price Performance

Shares of Zillow Group stock traded up $1.28 on Friday, hitting $80.54. The company had a trading volume of 135,096 shares, compared to its average volume of 624,826. Zillow Group, Inc. has a 52 week low of $38.06 and a 52 week high of $80.76. The company has a market cap of $18.81 billion, a PE ratio of -138.47 and a beta of 2.02. The business has a 50-day simple moving average of $63.21 and a 200-day simple moving average of $52.46. The company has a debt-to-equity ratio of 0.11, a current ratio of 3.13 and a quick ratio of 3.13.

Zillow Group (NASDAQ:ZG - Get Free Report) last posted its quarterly earnings data on Wednesday, November 6th. The technology company reported $0.35 earnings per share for the quarter, beating the consensus estimate of $0.32 by $0.03. The company had revenue of $581.00 million during the quarter, compared to analyst estimates of $555.45 million. Zillow Group had a negative net margin of 6.17% and a negative return on equity of 2.33%. The business's revenue for the quarter was up 17.1% on a year-over-year basis. During the same quarter last year, the firm posted ($0.12) EPS. Research analysts expect that Zillow Group, Inc. will post -0.33 EPS for the current fiscal year.

Hedge Funds Weigh In On Zillow Group

“Trump Trades” You’ve Got to Make

From StockEarnings | Ad

These Stocks are the Best “Trump Trades”

Free e-book reveals sectors – and stocks within them – likely to pop now that Donald Trump has been re-elected

Claim your copy before they move

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in ZG. Cynosure Group LLC acquired a new position in shares of Zillow Group in the 3rd quarter valued at about $12,248,000. Mirabella Financial Services LLP acquired a new stake in shares of Zillow Group in the 3rd quarter valued at $11,351,000. Philadelphia Financial Management of San Francisco LLC bought a new stake in shares of Zillow Group during the 3rd quarter worth about $9,813,000. Virtu Financial LLC boosted its position in Zillow Group by 132.1% during the third quarter. Virtu Financial LLC now owns 208,773 shares of the technology company's stock worth $12,929,000 after purchasing an additional 118,830 shares during the period. Finally, CreativeOne Wealth LLC boosted its holdings in shares of Zillow Group by 164.4% during the 3rd quarter. CreativeOne Wealth LLC now owns 179,700 shares of the technology company's stock worth $11,129,000 after buying an additional 111,743 shares during the period. Institutional investors and hedge funds own 20.32% of the company's stock.

Analyst Upgrades and Downgrades

Several equities analysts recently commented on the stock. Citigroup upped their price target on shares of Zillow Group from $58.00 to $62.00 and gave the stock a "buy" rating in a research report on Thursday, August 8th. Piper Sandler reiterated an "overweight" rating and set a $73.00 price objective (up from $62.00) on shares of Zillow Group in a research note on Thursday, November 7th. JMP Securities raised their target price on shares of Zillow Group from $62.00 to $82.00 and gave the company a "market outperform" rating in a research note on Thursday, November 7th. Cantor Fitzgerald restated a "neutral" rating and set a $47.00 target price on shares of Zillow Group in a report on Monday, October 7th. Finally, Wedbush upgraded Zillow Group from a "neutral" rating to an "outperform" rating and increased their price target for the company from $50.00 to $80.00 in a report on Monday, September 16th. One equities research analyst has rated the stock with a sell rating, five have assigned a hold rating and twelve have issued a buy rating to the company. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $68.18.

Get Our Latest Report on ZG

About Zillow Group

(

Get Free Report)

Zillow Group, Inc operates real estate brands in mobile applications and Websites in the United States. The company offers premier agent and rentals marketplaces, new construction marketplaces, advertising, display advertising, and business technology solutions, as well as dotloop and floor plans. It also provides mortgage originations and the sale of mortgages, and advertising to mortgage lenders and other mortgage professionals; and title and escrow services.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].