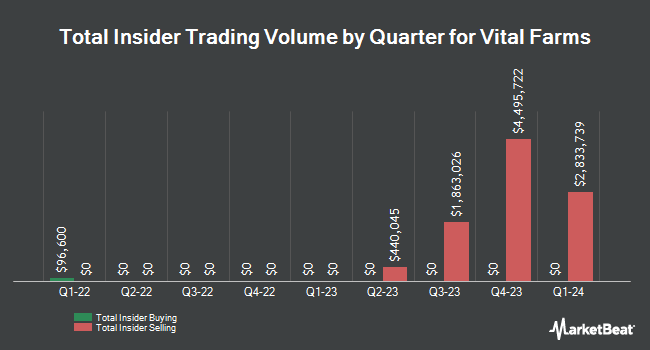

Vital Farms, Inc. (NASDAQ:VITL - Get Free Report) CEO Russell Diez-Canseco sold 44,728 shares of the business's stock in a transaction that occurred on Thursday, December 12th. The stock was sold at an average price of $37.66, for a total transaction of $1,684,456.48. Following the sale, the chief executive officer now directly owns 613,797 shares in the company, valued at approximately $23,115,595.02. This represents a 6.79 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink.

Vital Farms, Inc. (NASDAQ:VITL - Get Free Report) CEO Russell Diez-Canseco sold 44,728 shares of the business's stock in a transaction that occurred on Thursday, December 12th. The stock was sold at an average price of $37.66, for a total transaction of $1,684,456.48. Following the sale, the chief executive officer now directly owns 613,797 shares in the company, valued at approximately $23,115,595.02. This represents a 6.79 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink.

Russell Diez-Canseco also recently made the following trade(s):

- On Monday, October 14th, Russell Diez-Canseco sold 44,653 shares of Vital Farms stock. The stock was sold at an average price of $40.07, for a total transaction of $1,789,245.71.

Vital Farms Stock Performance

NASDAQ VITL opened at $38.85 on Tuesday. Vital Farms, Inc. has a fifty-two week low of $14.14 and a fifty-two week high of $48.41. The company has a debt-to-equity ratio of 0.04, a quick ratio of 2.81 and a current ratio of 3.24. The firm has a market capitalization of $1.70 billion, a P/E ratio of 34.69 and a beta of 0.93. The stock has a 50-day simple moving average of $34.88 and a two-hundred day simple moving average of $36.38.

First JFK… next Elon?

From Porter & Company | Ad

Today, I have another controversial prediction.

One which I will take no pleasure in seeing come true.

See, even with President Trump returning as the leader of our free country, I believe Elon Musk is in mortal danger.

I share with you in this special investigative documentary.

Vital Farms (NASDAQ:VITL - Get Free Report) last announced its quarterly earnings results on Thursday, November 7th. The company reported $0.16 earnings per share for the quarter, beating the consensus estimate of $0.14 by $0.02. Vital Farms had a return on equity of 22.29% and a net margin of 8.68%. The company had revenue of $145.00 million during the quarter, compared to analysts' expectations of $145.27 million. During the same period last year, the business earned $0.10 earnings per share. Vital Farms's quarterly revenue was up 31.3% on a year-over-year basis. On average, equities analysts forecast that Vital Farms, Inc. will post 1.11 earnings per share for the current year.

Institutional Trading of Vital Farms

A number of hedge funds have recently added to or reduced their stakes in VITL. Marshall Wace LLP increased its holdings in Vital Farms by 29.7% in the second quarter. Marshall Wace LLP now owns 937,755 shares of the company's stock valued at $43,859,000 after buying an additional 214,839 shares in the last quarter. Renaissance Technologies LLC increased its stake in shares of Vital Farms by 73.0% in the 2nd quarter. Renaissance Technologies LLC now owns 784,153 shares of the company's stock valued at $36,675,000 after purchasing an additional 331,000 shares in the last quarter. Geode Capital Management LLC increased its stake in shares of Vital Farms by 4.3% in the 3rd quarter. Geode Capital Management LLC now owns 749,659 shares of the company's stock valued at $26,296,000 after purchasing an additional 31,187 shares in the last quarter. Emerald Advisers LLC raised its holdings in Vital Farms by 106.8% in the 3rd quarter. Emerald Advisers LLC now owns 706,440 shares of the company's stock worth $24,775,000 after purchasing an additional 364,837 shares during the period. Finally, Acadian Asset Management LLC boosted its position in Vital Farms by 73.6% during the second quarter. Acadian Asset Management LLC now owns 679,504 shares of the company's stock worth $31,766,000 after purchasing an additional 288,039 shares in the last quarter. 98.59% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

VITL has been the subject of a number of research analyst reports. DA Davidson raised their target price on Vital Farms from $44.00 to $48.00 and gave the stock a "buy" rating in a research note on Thursday, October 10th. TD Cowen decreased their target price on Vital Farms from $46.00 to $41.00 and set a "buy" rating for the company in a report on Friday, November 8th. Finally, Jefferies Financial Group cut their price target on shares of Vital Farms from $45.00 to $41.00 and set a "buy" rating on the stock in a report on Monday, November 11th. One research analyst has rated the stock with a hold rating and five have given a buy rating to the company. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus price target of $39.20.

Check Out Our Latest Stock Report on VITL

About Vital Farms

(

Get Free Report)

Vital Farms, Inc, a food company, provides pasture-raised products in the United States. It offers shell eggs, butter, hard-boiled eggs, and liquid whole eggs. The company was founded in 2007 and is headquartered in Austin, Texas.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].