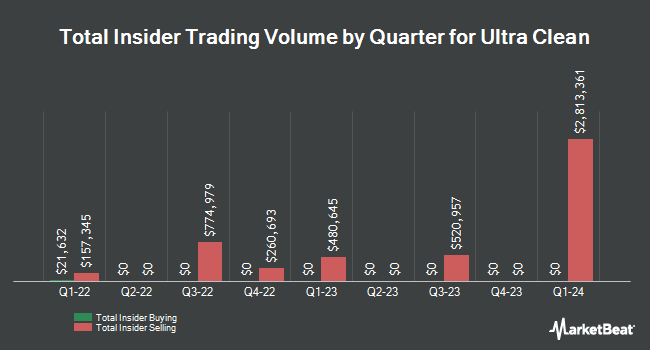

Ultra Clean Holdings, Inc. (NASDAQ:UCTT - Get Free Report) insider Bill Bentinck purchased 3,000 shares of the stock in a transaction on Friday, March 7th. The stock was bought at an average price of $25.17 per share, for a total transaction of $75,510.00. Following the completion of the transaction, the insider now directly owns 60,695 shares of the company's stock, valued at approximately $1,527,693.15. This trade represents a 5.20 % increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink.

Ultra Clean Holdings, Inc. (NASDAQ:UCTT - Get Free Report) insider Bill Bentinck purchased 3,000 shares of the stock in a transaction on Friday, March 7th. The stock was bought at an average price of $25.17 per share, for a total transaction of $75,510.00. Following the completion of the transaction, the insider now directly owns 60,695 shares of the company's stock, valued at approximately $1,527,693.15. This trade represents a 5.20 % increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink.

Ultra Clean Stock Down 3.0 %

Shares of UCTT opened at $22.98 on Wednesday. The company has a market capitalization of $1.04 billion, a PE ratio of 287.29, a PEG ratio of 0.51 and a beta of 2.20. The company has a current ratio of 2.75, a quick ratio of 1.63 and a debt-to-equity ratio of 0.52. The stock's 50-day moving average price is $34.82 and its two-hundred day moving average price is $36.00. Ultra Clean Holdings, Inc. has a 12 month low of $22.40 and a 12 month high of $56.47.

Institutional Investors Weigh In On Ultra Clean

Institutional investors and hedge funds have recently made changes to their positions in the business. Headlands Technologies LLC bought a new stake in shares of Ultra Clean in the 4th quarter worth approximately $26,000. Point72 Asia Singapore Pte. Ltd. acquired a new stake in Ultra Clean in the third quarter valued at approximately $32,000. Nisa Investment Advisors LLC increased its holdings in Ultra Clean by 107.0% in the fourth quarter. Nisa Investment Advisors LLC now owns 948 shares of the semiconductor company's stock valued at $34,000 after buying an additional 490 shares in the last quarter. Smartleaf Asset Management LLC boosted its position in Ultra Clean by 694.3% during the fourth quarter. Smartleaf Asset Management LLC now owns 977 shares of the semiconductor company's stock worth $35,000 after acquiring an additional 854 shares during the last quarter. Finally, Quarry LP boosted its holdings in Ultra Clean by 447.5% in the 3rd quarter. Quarry LP now owns 1,210 shares of the semiconductor company's stock valued at $48,000 after purchasing an additional 989 shares during the last quarter. Hedge funds and other institutional investors own 96.06% of the company's stock.

Analysts Set New Price Targets

Separately, Needham & Company LLC reaffirmed a "buy" rating and set a $40.00 price target on shares of Ultra Clean in a research note on Thursday, March 6th.

Get Our Latest Research Report on Ultra Clean

Ultra Clean Company Profile

(

Get Free Report)

Ultra Clean Holdings, Inc develops and supplies critical subsystems, components and parts, and ultra-high purity cleaning and analytical services for the semiconductor industry in the United States and internationally. The company provides ultra-clean valves, high purity connectors, industrial process connectors and valves, pneumatic actuators, manifolds and safety solutions, hoses, pressure gauges, and gas line and component heaters; chemical delivery modules that deliver gases and reactive chemicals in a liquid or gaseous form from a centralized subsystem to the reaction chamber; and gas delivery systems, such as weldments, filters, mass flow controllers, regulators, pressure transducers and valves, component heaters, and an integrated electronic and/or pneumatic control system.

Read More

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to contact@insidertrades.com.