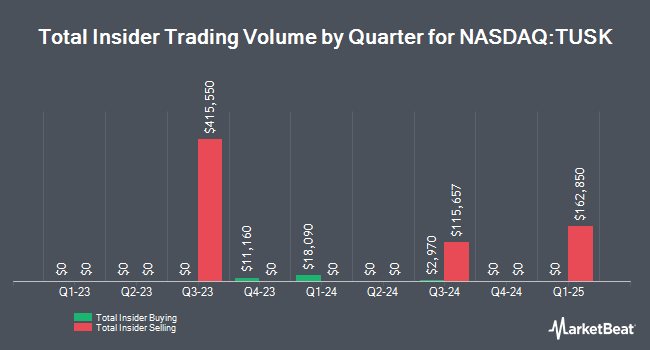

Mammoth Energy Services, Inc. (NASDAQ:TUSK - Get Free Report) Director Corey J. Booker sold 3,494 shares of the business's stock in a transaction dated Monday, November 11th. The stock was sold at an average price of $3.61, for a total transaction of $12,613.34. Following the completion of the transaction, the director now directly owns 172,904 shares in the company, valued at $624,183.44. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link.

Mammoth Energy Services, Inc. (NASDAQ:TUSK - Get Free Report) Director Corey J. Booker sold 3,494 shares of the business's stock in a transaction dated Monday, November 11th. The stock was sold at an average price of $3.61, for a total transaction of $12,613.34. Following the completion of the transaction, the director now directly owns 172,904 shares in the company, valued at $624,183.44. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link.

Mammoth Energy Services Stock Performance

Shares of NASDAQ TUSK opened at $3.46 on Wednesday. Mammoth Energy Services, Inc. has a 12 month low of $2.50 and a 12 month high of $4.95. The company has a debt-to-equity ratio of 0.18, a current ratio of 2.25 and a quick ratio of 2.13. The business has a 50-day moving average of $4.08 and a 200-day moving average of $3.72.

Mammoth Energy Services (NASDAQ:TUSK - Get Free Report) last issued its earnings results on Friday, November 1st. The energy company reported ($0.50) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.01) by ($0.49). The firm had revenue of $40.02 million during the quarter. Mammoth Energy Services had a negative return on equity of 53.85% and a negative net margin of 105.49%. During the same period in the prior year, the company posted ($0.02) earnings per share.

Analysts Set New Price Targets

Urgent: This election is rigged

From Porter & Company | Ad

If you missed it, my emergency election broadcast is now available - but will be removed soon

Click here to watch it now.

Separately, StockNews.com raised shares of Mammoth Energy Services from a "sell" rating to a "hold" rating in a report on Monday, November 4th.

Get Our Latest Research Report on TUSK

Institutional Trading of Mammoth Energy Services

Several hedge funds and other institutional investors have recently bought and sold shares of the company. BNP Paribas Financial Markets boosted its stake in Mammoth Energy Services by 55.8% in the first quarter. BNP Paribas Financial Markets now owns 11,265 shares of the energy company's stock worth $41,000 after buying an additional 4,035 shares in the last quarter. Empowered Funds LLC boosted its stake in shares of Mammoth Energy Services by 5.3% during the third quarter. Empowered Funds LLC now owns 83,157 shares of the energy company's stock valued at $340,000 after purchasing an additional 4,154 shares during the period. SG Americas Securities LLC purchased a new stake in shares of Mammoth Energy Services during the third quarter valued at approximately $42,000. Bank of New York Mellon Corp boosted its stake in shares of Mammoth Energy Services by 6.9% during the second quarter. Bank of New York Mellon Corp now owns 166,591 shares of the energy company's stock valued at $546,000 after purchasing an additional 10,796 shares during the period. Finally, Vanguard Group Inc. boosted its stake in shares of Mammoth Energy Services by 2.5% during the first quarter. Vanguard Group Inc. now owns 723,772 shares of the energy company's stock valued at $2,635,000 after purchasing an additional 17,369 shares during the period. Hedge funds and other institutional investors own 79.67% of the company's stock.

About Mammoth Energy Services

(

Get Free Report)

Mammoth Energy Services, Inc operates as an energy services company in the United States, Canada, and internationally. The company operates in four segments: Well Completion Services, Infrastructure Services, Natural Sand Proppant Services, and Drilling Services. The company offers pressure pumping and hydraulic fracturing, sand hauling, and water transfer services; and master services agreements.

Further Reading

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].