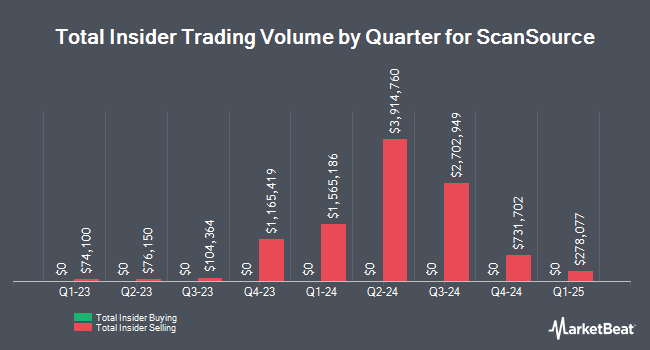

ScanSource, Inc. (NASDAQ:SCSC - Get Free Report) CFO Stephen Jones sold 2,000 shares of the stock in a transaction on Friday, March 21st. The shares were sold at an average price of $36.14, for a total value of $72,280.00. Following the sale, the chief financial officer now owns 69,816 shares in the company, valued at approximately $2,523,150.24. This trade represents a 2.78 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link.

ScanSource, Inc. (NASDAQ:SCSC - Get Free Report) CFO Stephen Jones sold 2,000 shares of the stock in a transaction on Friday, March 21st. The shares were sold at an average price of $36.14, for a total value of $72,280.00. Following the sale, the chief financial officer now owns 69,816 shares in the company, valued at approximately $2,523,150.24. This trade represents a 2.78 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link.

ScanSource Stock Performance

NASDAQ SCSC opened at $36.28 on Wednesday. The company has a quick ratio of 1.30, a current ratio of 2.11 and a debt-to-equity ratio of 0.15. ScanSource, Inc. has a fifty-two week low of $34.49 and a fifty-two week high of $53.90. The business has a fifty day moving average of $40.25 and a 200-day moving average of $45.57. The stock has a market cap of $851.27 million, a price-to-earnings ratio of 14.34, a price-to-earnings-growth ratio of 1.14 and a beta of 1.41.

ScanSource (NASDAQ:SCSC - Get Free Report) last released its earnings results on Thursday, January 30th. The industrial products company reported $0.85 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.89 by ($0.04). ScanSource had a net margin of 2.08% and a return on equity of 8.55%. During the same quarter in the previous year, the business earned $0.85 earnings per share. As a group, analysts predict that ScanSource, Inc. will post 3.33 earnings per share for the current fiscal year.

Institutional Trading of ScanSource

A number of hedge funds have recently bought and sold shares of the company. Castlekeep Investment Advisors LLC acquired a new position in ScanSource in the 4th quarter valued at $78,694,000. Wasatch Advisors LP lifted its position in ScanSource by 13.2% during the third quarter. Wasatch Advisors LP now owns 1,097,992 shares of the industrial products company's stock worth $52,737,000 after buying an additional 127,883 shares during the period. American Century Companies Inc. boosted its stake in ScanSource by 13.1% in the 4th quarter. American Century Companies Inc. now owns 759,318 shares of the industrial products company's stock worth $36,030,000 after buying an additional 87,721 shares during the last quarter. Invesco Ltd. grew its holdings in ScanSource by 2.4% in the 4th quarter. Invesco Ltd. now owns 618,099 shares of the industrial products company's stock valued at $29,329,000 after buying an additional 14,669 shares during the period. Finally, JPMorgan Chase & Co. increased its stake in shares of ScanSource by 15.6% during the 4th quarter. JPMorgan Chase & Co. now owns 436,007 shares of the industrial products company's stock valued at $20,689,000 after acquiring an additional 58,927 shares during the last quarter. Institutional investors and hedge funds own 97.91% of the company's stock.

About ScanSource

(

Get Free Report)

ScanSource, Inc engages in the distribution of technology products and solutions in the United States, Canada, and Brazil. It operates through two segments, Specialty Technology Solutions and Modern Communications & Cloud. The Specialty Technology Solutions segment provides a portfolio of solutions primarily for enterprise mobile computing, data capture, barcode printing, point of sale (POS), payments, networking, electronic physical security, cyber security, and other technologies.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to contact@insidertrades.com.