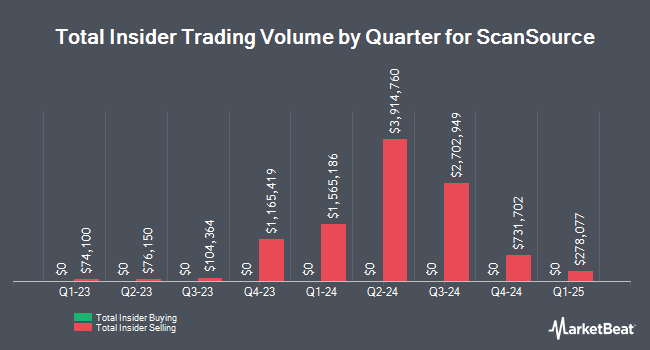

ScanSource, Inc. (NASDAQ:SCSC - Get Free Report) CEO Michael L. Baur sold 8,312 shares of the company's stock in a transaction on Wednesday, November 20th. The shares were sold at an average price of $48.98, for a total transaction of $407,121.76. Following the transaction, the chief executive officer now owns 177,760 shares of the company's stock, valued at approximately $8,706,684.80. The trade was a 4.47 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this link.

ScanSource, Inc. (NASDAQ:SCSC - Get Free Report) CEO Michael L. Baur sold 8,312 shares of the company's stock in a transaction on Wednesday, November 20th. The shares were sold at an average price of $48.98, for a total transaction of $407,121.76. Following the transaction, the chief executive officer now owns 177,760 shares of the company's stock, valued at approximately $8,706,684.80. The trade was a 4.47 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this link.

ScanSource Stock Performance

Shares of SCSC stock traded up $1.24 during mid-day trading on Friday, reaching $51.13. The stock had a trading volume of 22,649 shares, compared to its average volume of 208,960. The firm has a market cap of $1.22 billion, a PE ratio of 15.99, a P/E/G ratio of 1.40 and a beta of 1.42. The company has a quick ratio of 1.27, a current ratio of 2.03 and a debt-to-equity ratio of 0.15. ScanSource, Inc. has a one year low of $31.01 and a one year high of $53.76. The firm's 50 day simple moving average is $47.60 and its 200 day simple moving average is $47.23.

ScanSource (NASDAQ:SCSC - Get Free Report) last posted its quarterly earnings results on Thursday, November 7th. The industrial products company reported $0.84 earnings per share for the quarter, topping analysts' consensus estimates of $0.77 by $0.07. The firm had revenue of $775.58 million for the quarter, compared to the consensus estimate of $774.90 million. ScanSource had a net margin of 2.49% and a return on equity of 8.53%. The business's revenue was down 11.5% compared to the same quarter last year. During the same quarter in the previous year, the company earned $0.74 earnings per share. On average, analysts forecast that ScanSource, Inc. will post 3.51 EPS for the current year.

Institutional Trading of ScanSource

Coins Set to Soar with a Pro-Crypto White House

From Crypto 101 Media | Ad

Coins Set to Soar with a Pro-Crypto White House

President-Elect Donald Trump is reported to be holding over $3 Million worth of crypto – and he's not the only one at the top interested in digital assets…

Click here to reserve your free seat at the Crypto Community Summit

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the business. Gladius Capital Management LP acquired a new stake in ScanSource during the third quarter valued at approximately $30,000. CWM LLC boosted its stake in ScanSource by 164.1% in the 2nd quarter. CWM LLC now owns 647 shares of the industrial products company's stock valued at $29,000 after buying an additional 402 shares in the last quarter. Point72 DIFC Ltd bought a new stake in ScanSource in the third quarter valued at $35,000. nVerses Capital LLC acquired a new position in ScanSource during the second quarter worth $40,000. Finally, Quest Partners LLC bought a new position in shares of ScanSource during the second quarter valued at $41,000. Institutional investors own 97.91% of the company's stock.

Analyst Ratings Changes

Separately, Raymond James lowered shares of ScanSource from an "outperform" rating to a "market perform" rating in a research report on Thursday, August 15th.

Read Our Latest Stock Analysis on SCSC

ScanSource Company Profile

(

Get Free Report)

ScanSource, Inc engages in the distribution of technology products and solutions in the United States, Canada, and Brazil. It operates through two segments, Specialty Technology Solutions and Modern Communications & Cloud. The Specialty Technology Solutions segment provides a portfolio of solutions primarily for enterprise mobile computing, data capture, barcode printing, point of sale (POS), payments, networking, electronic physical security, cyber security, and other technologies.

See Also

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].