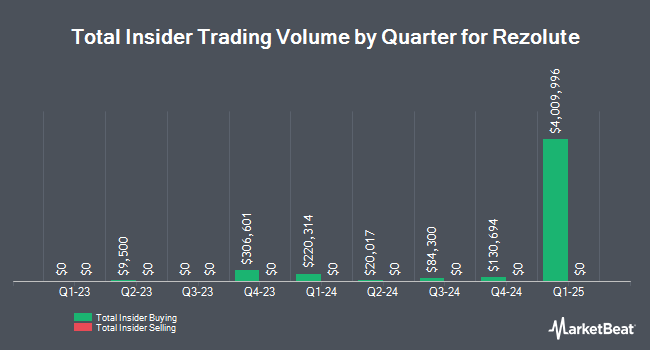

Rezolute, Inc. (NASDAQ:RZLT - Get Free Report) CFO Daron Evans bought 9,000 shares of the firm's stock in a transaction on Thursday, December 12th. The shares were purchased at an average cost of $4.60 per share, with a total value of $41,400.00. Following the transaction, the chief financial officer now directly owns 140,900 shares in the company, valued at approximately $648,140. This trade represents a 6.82 % increase in their position. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this link.

Rezolute, Inc. (NASDAQ:RZLT - Get Free Report) CFO Daron Evans bought 9,000 shares of the firm's stock in a transaction on Thursday, December 12th. The shares were purchased at an average cost of $4.60 per share, with a total value of $41,400.00. Following the transaction, the chief financial officer now directly owns 140,900 shares in the company, valued at approximately $648,140. This trade represents a 6.82 % increase in their position. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this link.

Rezolute Trading Down 6.1 %

Shares of Rezolute stock opened at $4.64 on Friday. The business's fifty day simple moving average is $5.17 and its 200 day simple moving average is $4.76. Rezolute, Inc. has a 12 month low of $0.76 and a 12 month high of $6.19.

Rezolute (NASDAQ:RZLT - Get Free Report) last issued its quarterly earnings results on Thursday, September 19th. The company reported ($0.44) earnings per share for the quarter, missing analysts' consensus estimates of ($0.30) by ($0.14). On average, sell-side analysts predict that Rezolute, Inc. will post -0.99 earnings per share for the current year.

Wall Street Analysts Forecast Growth

Nvidia’s Bold Move: Tackling Tech’s $1 Trillion Crisis

From Weiss Ratings | Ad

Taiwan Semiconductor, a partner of Nvidia’s for more than two decades, has seen its shares explode as much as 4,744%.

Now, if you’re like everybody else, you want to know what Nvidia’s doing next … and who they’re going to partner with …

Find out details on these three critical Nvidia partners immediately.

A number of brokerages have weighed in on RZLT. Guggenheim started coverage on Rezolute in a report on Tuesday, August 27th. They issued a "buy" rating and a $11.00 target price for the company. BTIG Research increased their target price on shares of Rezolute from $13.00 to $15.00 and gave the stock a "buy" rating in a research note on Tuesday, September 10th. HC Wainwright restated a "buy" rating and issued a $14.00 price target on shares of Rezolute in a report on Friday, November 8th. JMP Securities reissued a "market outperform" rating and set a $7.00 price objective on shares of Rezolute in a research report on Friday, September 20th. Finally, Wedbush reaffirmed an "outperform" rating and issued a $112.00 target price on shares of Rezolute in a research report on Monday, November 4th. Eight equities research analysts have rated the stock with a buy rating, According to data from MarketBeat, the stock currently has an average rating of "Buy" and an average price target of $24.13.

Read Our Latest Stock Analysis on Rezolute

Institutional Inflows and Outflows

Several large investors have recently bought and sold shares of the company. Vanguard Group Inc. raised its position in shares of Rezolute by 10.4% in the first quarter. Vanguard Group Inc. now owns 1,553,352 shares of the company's stock worth $3,961,000 after buying an additional 145,700 shares in the last quarter. Jeppson Wealth Management LLC bought a new position in Rezolute in the 2nd quarter worth about $45,000. Acadian Asset Management LLC raised its holdings in shares of Rezolute by 104.2% in the 2nd quarter. Acadian Asset Management LLC now owns 184,502 shares of the company's stock valued at $792,000 after acquiring an additional 94,156 shares in the last quarter. Federated Hermes Inc. boosted its position in shares of Rezolute by 11.1% during the 2nd quarter. Federated Hermes Inc. now owns 11,279,327 shares of the company's stock valued at $48,501,000 after acquiring an additional 1,125,000 shares during the last quarter. Finally, Dimensional Fund Advisors LP purchased a new position in shares of Rezolute during the second quarter worth about $255,000. 82.97% of the stock is owned by institutional investors.

Rezolute Company Profile

(

Get Free Report)

Rezolute, Inc, a clinical stage biopharmaceutical company, develops therapies for metabolic diseases associated with chronic glucose imbalance in the United States. The company's lead product candidate is RZ358, a human monoclonal antibody that is in Phase 2b clinical trial for the treatment of congenital hyperinsulinism, an ultra-rare pediatric genetic disorder.

Read More

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].