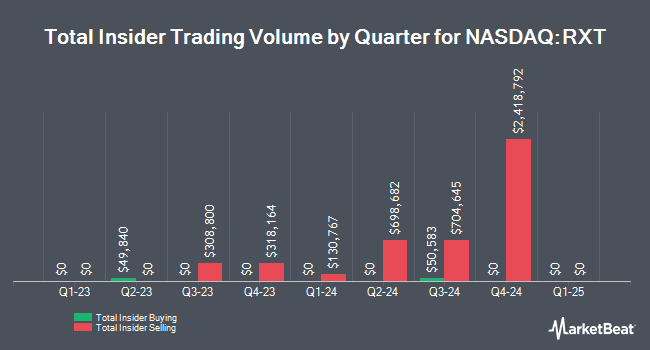

Rackspace Technology, Inc. (NASDAQ:RXT - Get Free Report) insider Srini Koushik sold 8,028 shares of the stock in a transaction on Tuesday, December 3rd. The stock was sold at an average price of $2.54, for a total value of $20,391.12. Following the completion of the transaction, the insider now owns 1,018,251 shares in the company, valued at approximately $2,586,357.54. This represents a 0.78 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link.

Rackspace Technology, Inc. (NASDAQ:RXT - Get Free Report) insider Srini Koushik sold 8,028 shares of the stock in a transaction on Tuesday, December 3rd. The stock was sold at an average price of $2.54, for a total value of $20,391.12. Following the completion of the transaction, the insider now owns 1,018,251 shares in the company, valued at approximately $2,586,357.54. This represents a 0.78 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link.

Srini Koushik also recently made the following trade(s):

- On Friday, November 29th, Srini Koushik sold 19,470 shares of Rackspace Technology stock. The shares were sold at an average price of $2.67, for a total transaction of $51,984.90.

Rackspace Technology Trading Down 1.1 %

Shares of RXT opened at $2.58 on Friday. The stock has a 50 day moving average of $2.58 and a 200 day moving average of $2.45. The company has a market capitalization of $587.13 million, a price-to-earnings ratio of -0.74 and a beta of 1.99. Rackspace Technology, Inc. has a 12 month low of $1.36 and a 12 month high of $3.41.

Why Buffett, Griffin and 100 members of Congress are Piling into this One Investment

From Behind the Markets | Ad

This isn't just another investment.

It might be the last retirement stock you'll ever need.

But this window of opportunity is closing fast.

Click here for the ticker >>>

Rackspace Technology (NASDAQ:RXT - Get Free Report) last issued its quarterly earnings results on Tuesday, November 12th. The company reported ($0.04) earnings per share for the quarter, topping analysts' consensus estimates of ($0.07) by $0.03. The company had revenue of $675.80 million during the quarter, compared to analysts' expectations of $675.14 million. Rackspace Technology's quarterly revenue was down 7.7% compared to the same quarter last year. During the same period last year, the firm posted ($0.04) earnings per share. As a group, equities research analysts predict that Rackspace Technology, Inc. will post -0.27 earnings per share for the current year.

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently modified their holdings of RXT. Renaissance Technologies LLC raised its holdings in shares of Rackspace Technology by 23.7% in the 2nd quarter. Renaissance Technologies LLC now owns 1,339,200 shares of the company's stock worth $3,991,000 after purchasing an additional 256,900 shares during the period. Jacobs Levy Equity Management Inc. grew its holdings in Rackspace Technology by 139.4% during the third quarter. Jacobs Levy Equity Management Inc. now owns 814,624 shares of the company's stock valued at $1,996,000 after purchasing an additional 474,299 shares during the period. Jane Street Group LLC increased its position in Rackspace Technology by 27.4% in the third quarter. Jane Street Group LLC now owns 773,454 shares of the company's stock worth $1,895,000 after buying an additional 166,528 shares during the last quarter. Charles Schwab Investment Management Inc. raised its stake in shares of Rackspace Technology by 7.6% in the third quarter. Charles Schwab Investment Management Inc. now owns 590,724 shares of the company's stock valued at $1,447,000 after buying an additional 41,697 shares during the period. Finally, ClariVest Asset Management LLC lifted its position in shares of Rackspace Technology by 2.8% during the 2nd quarter. ClariVest Asset Management LLC now owns 379,721 shares of the company's stock valued at $1,132,000 after buying an additional 10,281 shares during the last quarter. 82.48% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

A number of research firms recently weighed in on RXT. UBS Group upped their target price on shares of Rackspace Technology from $2.10 to $2.30 and gave the stock a "neutral" rating in a report on Friday, August 16th. Barclays lifted their target price on Rackspace Technology from $1.00 to $2.00 and gave the company an "underweight" rating in a research report on Monday, November 18th. One equities research analyst has rated the stock with a sell rating, four have issued a hold rating and one has assigned a buy rating to the company. According to MarketBeat.com, the company has an average rating of "Hold" and an average price target of $2.47.

Check Out Our Latest Stock Report on RXT

About Rackspace Technology

(

Get Free Report)

Rackspace Technology, Inc operates as a multi cloud technology services company in the Americas, Europe, the Middle East, Africa, and The Asia-Pacific region. It operates through three segments: Multicloud Services, Apps & Cross Platform, and OpenStack Public Cloud. The company provides public and private cloud managed services, which allow customers to determine, manage, and optimize the right infrastructure, platforms, and services; professional services related to designing and building multi cloud solutions and cloud-native applications; and managed hosting and colocation services.

Further Reading

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].