Paysign, Inc. (NASDAQ:PAYS - Get Free Report) CEO Mark Newcomer sold 41,000 shares of the business's stock in a transaction dated Monday, December 9th. The stock was sold at an average price of $3.31, for a total transaction of $135,710.00. Following the completion of the sale, the chief executive officer now owns 9,195,886 shares in the company, valued at approximately $30,438,382.66. This trade represents a 0.44 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website.

Paysign, Inc. (NASDAQ:PAYS - Get Free Report) CEO Mark Newcomer sold 41,000 shares of the business's stock in a transaction dated Monday, December 9th. The stock was sold at an average price of $3.31, for a total transaction of $135,710.00. Following the completion of the sale, the chief executive officer now owns 9,195,886 shares in the company, valued at approximately $30,438,382.66. This trade represents a 0.44 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website.

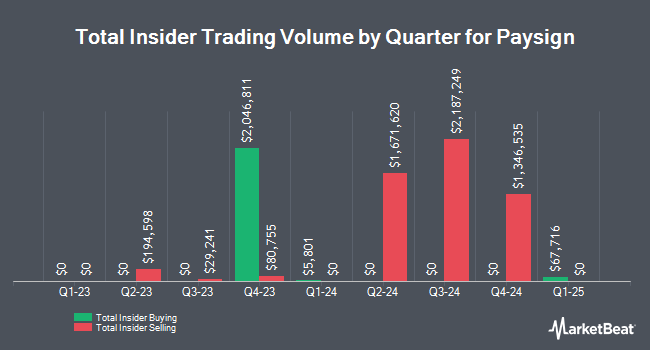

Mark Newcomer also recently made the following trade(s):

- On Wednesday, November 20th, Mark Newcomer sold 25,000 shares of Paysign stock. The stock was sold at an average price of $3.27, for a total transaction of $81,750.00.

- On Monday, November 18th, Mark Newcomer sold 40,000 shares of Paysign stock. The stock was sold at an average price of $3.24, for a total transaction of $129,600.00.

- On Wednesday, October 23rd, Mark Newcomer sold 36,000 shares of Paysign stock. The stock was sold at an average price of $3.66, for a total transaction of $131,760.00.

- On Monday, October 21st, Mark Newcomer sold 22,000 shares of Paysign stock. The shares were sold at an average price of $3.75, for a total value of $82,500.00.

- On Monday, September 23rd, Mark Newcomer sold 50,000 shares of Paysign stock. The stock was sold at an average price of $4.25, for a total value of $212,500.00.

- On Thursday, September 19th, Mark Newcomer sold 1,500 shares of Paysign stock. The shares were sold at an average price of $4.50, for a total value of $6,750.00.

- On Friday, September 13th, Mark Newcomer sold 1,500 shares of Paysign stock. The stock was sold at an average price of $4.50, for a total value of $6,750.00.

Paysign Price Performance

Did You See Trump’s Bombshell Exec. Order 001?

From Banyan Hill Publishing | Ad

Biden broke it... Now Trump is going to fix it.

Starting with "Exec. Order 001."

I put all the details together for you here — but please hurry.

PAYS opened at $3.19 on Thursday. The firm has a market capitalization of $170.82 million, a P/E ratio of 21.27 and a beta of 0.93. The stock has a fifty day moving average of $3.61 and a 200-day moving average of $4.14. Paysign, Inc. has a 12-month low of $2.40 and a 12-month high of $5.59.

Paysign (NASDAQ:PAYS - Get Free Report) last announced its quarterly earnings data on Tuesday, November 5th. The company reported $0.03 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.01 by $0.02. The firm had revenue of $15.26 million during the quarter, compared to the consensus estimate of $14.96 million. Paysign had a return on equity of 30.64% and a net margin of 14.28%. During the same period in the prior year, the business earned $0.02 EPS.

Institutional Investors Weigh In On Paysign

Institutional investors have recently made changes to their positions in the company. SG Americas Securities LLC bought a new stake in Paysign in the third quarter worth approximately $43,000. Algert Global LLC acquired a new stake in shares of Paysign in the second quarter worth about $46,000. The Manufacturers Life Insurance Company bought a new stake in shares of Paysign during the 2nd quarter worth about $66,000. American Century Companies Inc. acquired a new position in shares of Paysign during the 2nd quarter valued at about $92,000. Finally, Bard Associates Inc. bought a new position in shares of Paysign in the 3rd quarter valued at approximately $103,000. 25.89% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Separately, Barrington Research reiterated an "outperform" rating and issued a $7.00 target price on shares of Paysign in a report on Monday, November 4th.

Read Our Latest Stock Analysis on PAYS

Paysign Company Profile

(

Get Free Report)

Paysign, Inc provides prepaid card programs, comprehensive patient affordability offerings, digital banking services, and integrated payment processing services for businesses, consumers, and government institutions. Its product offerings include solutions for corporate rewards, prepaid gift cards, general purpose reloadable debit cards, employee incentives, consumer rebates, donor compensation, clinical trials, healthcare reimbursement payments and pharmaceutical payment assistance, and demand deposit accounts accessible with a debit card.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].