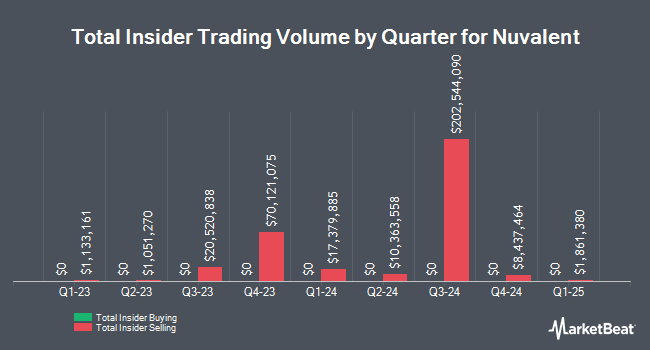

Nuvalent, Inc. (NASDAQ:NUVL - Get Free Report) CEO James Richard Porter sold 27,000 shares of Nuvalent stock in a transaction that occurred on Monday, December 16th. The stock was sold at an average price of $86.61, for a total value of $2,338,470.00. Following the completion of the sale, the chief executive officer now directly owns 188,113 shares in the company, valued at approximately $16,292,466.93. The trade was a 12.55 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink.

Nuvalent, Inc. (NASDAQ:NUVL - Get Free Report) CEO James Richard Porter sold 27,000 shares of Nuvalent stock in a transaction that occurred on Monday, December 16th. The stock was sold at an average price of $86.61, for a total value of $2,338,470.00. Following the completion of the sale, the chief executive officer now directly owns 188,113 shares in the company, valued at approximately $16,292,466.93. The trade was a 12.55 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink.

James Richard Porter also recently made the following trade(s):

- On Tuesday, October 15th, James Richard Porter sold 27,000 shares of Nuvalent stock. The shares were sold at an average price of $102.28, for a total transaction of $2,761,560.00.

Nuvalent Stock Performance

Shares of NASDAQ NUVL opened at $83.45 on Thursday. The business's 50 day moving average price is $93.95 and its 200-day moving average price is $86.98. Nuvalent, Inc. has a fifty-two week low of $61.79 and a fifty-two week high of $113.51. The company has a market cap of $5.93 billion, a price-to-earnings ratio of -24.05 and a beta of 1.31.

This Crypto Is Set to Explode in December

From Crypto 101 Media | Ad

It's a groundbreaking opportunity that could be poised for extraordinary gains.

The catalyst behind this surge is a massive new blockchain development…

YES, I WANT THE #1 CRYPTO NOW

Nuvalent (NASDAQ:NUVL - Get Free Report) last released its earnings results on Tuesday, November 12th. The company reported ($1.28) earnings per share for the quarter, missing the consensus estimate of ($0.93) by ($0.35). During the same period last year, the company posted ($0.59) earnings per share. Sell-side analysts predict that Nuvalent, Inc. will post -3.84 earnings per share for the current year.

Institutional Investors Weigh In On Nuvalent

Institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Amalgamated Bank lifted its holdings in shares of Nuvalent by 21.8% in the 2nd quarter. Amalgamated Bank now owns 1,105 shares of the company's stock worth $84,000 after buying an additional 198 shares during the period. HighVista Strategies LLC raised its holdings in shares of Nuvalent by 1.1% in the third quarter. HighVista Strategies LLC now owns 29,018 shares of the company's stock valued at $2,969,000 after acquiring an additional 320 shares in the last quarter. Mirae Asset Global Investments Co. Ltd. lifted its stake in Nuvalent by 21.6% in the third quarter. Mirae Asset Global Investments Co. Ltd. now owns 2,147 shares of the company's stock worth $213,000 after acquiring an additional 382 shares during the period. Quest Partners LLC bought a new position in Nuvalent during the 2nd quarter worth about $44,000. Finally, Arizona State Retirement System increased its position in Nuvalent by 15.9% during the 2nd quarter. Arizona State Retirement System now owns 8,215 shares of the company's stock valued at $623,000 after purchasing an additional 1,127 shares during the period. Institutional investors own 97.26% of the company's stock.

Analyst Ratings Changes

Several research firms have commented on NUVL. Wedbush reiterated an "outperform" rating and set a $115.00 price objective on shares of Nuvalent in a research report on Tuesday, November 12th. UBS Group assumed coverage on shares of Nuvalent in a research report on Thursday, October 24th. They set a "neutral" rating and a $100.00 target price on the stock. BMO Capital Markets lifted their price target on Nuvalent from $132.00 to $134.00 and gave the stock an "outperform" rating in a research report on Wednesday, November 13th. The Goldman Sachs Group upgraded Nuvalent to a "strong sell" rating in a research report on Monday, September 16th. Finally, JPMorgan Chase & Co. lifted their target price on Nuvalent from $100.00 to $125.00 and gave the stock an "overweight" rating in a report on Friday, October 4th. One investment analyst has rated the stock with a sell rating, one has issued a hold rating, ten have given a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $112.60.

View Our Latest Research Report on NUVL

About Nuvalent

(

Get Free Report)

Nuvalent, Inc, a clinical stage biopharmaceutical company, engages in the development of therapies for patients with cancer. Its lead product candidates are NVL-520, a novel ROS1-selective inhibitor to address the clinical challenges of emergent treatment resistance, central nervous system (CNS)-related adverse events, and brain metastases that may limit the use of ROS1 tyrosine kinase inhibitors (TKIs) for patients with ROS proto-oncogene 1 (ROS1)-positive non-small cell lung cancer (NSCLC) which is under the phase 2 portion of the ARROS-1 Phase 1/2 clinical trial; NVL-655, a brain-penetrant ALK-selective inhibitor, to address the clinical challenges of emergent treatment resistance, CNS-related adverse events, and brain metastases that might limit the use of first-, second-, and third-generation ALK inhibitors that is under the phase 2 portion of the ALKOVE-1 Phase 1/2 clinical trial; and NVL-330, a brain-penetrant human epidermal growth factor receptor 2 (HER2)-selective inhibitor designed to treat tumors driven by HER2ex20, brain metastases, and avoiding treatment-limiting adverse events including due to off-target inhibition of wild-type EGFR, which is expected to initiate phase 1 trial.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].