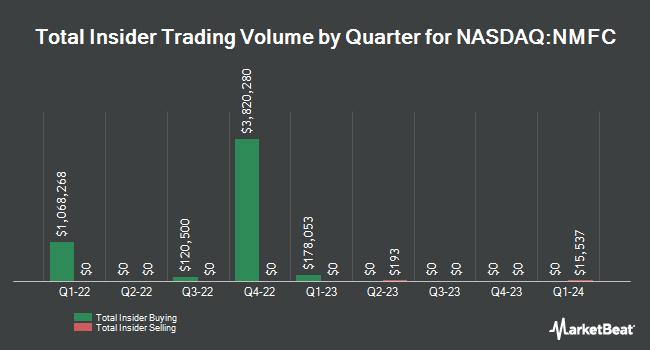

New Mountain Finance Co. (NASDAQ:NMFC - Get Free Report) Director Steven B. Klinsky purchased 16,624 shares of New Mountain Finance stock in a transaction on Thursday, December 5th. The shares were purchased at an average cost of $11.74 per share, with a total value of $195,165.76. Following the transaction, the director now owns 4,133,737 shares in the company, valued at approximately $48,530,072.38. The trade was a 0.40 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website.

New Mountain Finance Co. (NASDAQ:NMFC - Get Free Report) Director Steven B. Klinsky purchased 16,624 shares of New Mountain Finance stock in a transaction on Thursday, December 5th. The shares were purchased at an average cost of $11.74 per share, with a total value of $195,165.76. Following the transaction, the director now owns 4,133,737 shares in the company, valued at approximately $48,530,072.38. The trade was a 0.40 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website.

New Mountain Finance Price Performance

Shares of NMFC opened at $11.88 on Tuesday. New Mountain Finance Co. has a fifty-two week low of $10.61 and a fifty-two week high of $13.23. The company's 50-day moving average is $11.58 and its 200-day moving average is $12.03. The company has a debt-to-equity ratio of 1.46, a current ratio of 2.23 and a quick ratio of 2.23. The firm has a market capitalization of $1.28 billion, a PE ratio of 11.31 and a beta of 1.15.

New Mountain Finance (NASDAQ:NMFC - Get Free Report) last posted its quarterly earnings data on Wednesday, October 30th. The company reported $0.34 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.35 by ($0.01). New Mountain Finance had a net margin of 30.28% and a return on equity of 11.25%. The business had revenue of $95.33 million during the quarter, compared to the consensus estimate of $94.10 million. During the same period in the prior year, the firm earned $0.40 EPS. The business's revenue for the quarter was up 1.0% on a year-over-year basis. Equities analysts forecast that New Mountain Finance Co. will post 1.39 EPS for the current year.

New Mountain Finance Increases Dividend

URGENT: This Altcoin Opportunity Won’t Wait – Act Now

From Crypto Swap Profits | Ad

Crypto has officially entered the "banana zone" – that wild phase where prices can 1000x in days.

It happens like clockwork every 4 years, during the December to February window of a Bitcoin halving year.

This is where fortunes are made – often LITERALLY overnight.

>> Register for the Workshop Now

The company also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Tuesday, December 17th will be issued a $0.33 dividend. This is a positive change from New Mountain Finance's previous quarterly dividend of $0.32. This represents a $1.32 annualized dividend and a yield of 11.11%. The ex-dividend date of this dividend is Tuesday, December 17th. New Mountain Finance's dividend payout ratio (DPR) is currently 121.90%.

Institutional Inflows and Outflows

Institutional investors have recently added to or reduced their stakes in the company. BNP Paribas Financial Markets bought a new position in shares of New Mountain Finance in the third quarter worth about $26,000. Quarry LP lifted its position in shares of New Mountain Finance by 68.3% in the 2nd quarter. Quarry LP now owns 3,307 shares of the company's stock worth $40,000 after purchasing an additional 1,342 shares during the period. Clearstead Trust LLC bought a new stake in New Mountain Finance during the second quarter valued at $98,000. Quantbot Technologies LP acquired a new stake in New Mountain Finance during the third quarter worth approximately $129,000. Finally, Centiva Capital LP acquired a new stake in shares of New Mountain Finance during the 3rd quarter worth approximately $130,000. 32.08% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Separately, Wells Fargo & Company cut their price objective on New Mountain Finance from $12.00 to $11.00 and set an "equal weight" rating for the company in a report on Tuesday, October 29th.

Check Out Our Latest Analysis on NMFC

About New Mountain Finance

(

Get Free Report)

New Mountain Finance Corporation (Nasdaq: NMFC), a business development company is a private equity / buyouts and loan fund specializes in directly investing and lending to middle market companies in defensive growth industries. The fund prefers investing in buyout and middle market companies. It also makes investments in debt securities at all levels of the capital structure including first and second lien debt, unsecured notes, and mezzanine securities.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].