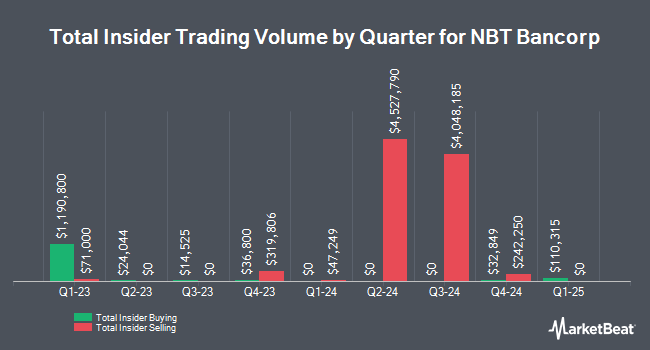

NBT Bancorp Inc. (NASDAQ:NBTB - Get Free Report) EVP Amy Wiles sold 500 shares of NBT Bancorp stock in a transaction that occurred on Friday, December 13th. The stock was sold at an average price of $51.31, for a total transaction of $25,655.00. Following the completion of the transaction, the executive vice president now owns 27,409 shares of the company's stock, valued at $1,406,355.79. This represents a 1.79 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link.

NBT Bancorp Inc. (NASDAQ:NBTB - Get Free Report) EVP Amy Wiles sold 500 shares of NBT Bancorp stock in a transaction that occurred on Friday, December 13th. The stock was sold at an average price of $51.31, for a total transaction of $25,655.00. Following the completion of the transaction, the executive vice president now owns 27,409 shares of the company's stock, valued at $1,406,355.79. This represents a 1.79 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link.

Amy Wiles also recently made the following trade(s):

- On Thursday, November 7th, Amy Wiles sold 1,000 shares of NBT Bancorp stock. The shares were sold at an average price of $50.10, for a total transaction of $50,100.00.

NBT Bancorp Stock Up 1.3 %

NBT Bancorp stock opened at $52.33 on Tuesday. The company has a market capitalization of $2.47 billion, a P/E ratio of 18.43 and a beta of 0.52. The company has a debt-to-equity ratio of 0.17, a quick ratio of 0.87 and a current ratio of 0.87. NBT Bancorp Inc. has a fifty-two week low of $32.79 and a fifty-two week high of $52.39. The stock has a 50-day simple moving average of $47.67 and a 200-day simple moving average of $44.57.

NBT Bancorp (NASDAQ:NBTB - Get Free Report) last released its quarterly earnings results on Monday, October 28th. The bank reported $0.80 EPS for the quarter, topping the consensus estimate of $0.78 by $0.02. The company had revenue of $202.00 million for the quarter, compared to analyst estimates of $144.70 million. NBT Bancorp had a return on equity of 9.36% and a net margin of 17.37%. During the same quarter in the previous year, the company posted $0.84 earnings per share. Equities research analysts expect that NBT Bancorp Inc. will post 2.94 earnings per share for the current year.

NBT Bancorp Announces Dividend

Healthcare Takes A Big Step Forward With The Help of A.I.

From Wall Street Star | Ad

To date, we've seen baseline AI models lay the groundwork. Tools like ChatGPT are useful, but they are still simple, proof-of-concept systems.

For its next act, AI is going to help save lives.

Already better than humans at a number of medical tasks, AI is ramping up to completely revolutionize healthcare.

Click here to learn more about the booming eHealth industry - and see which microcap will be at the

The firm also recently declared a quarterly dividend, which was paid on Monday, December 16th. Investors of record on Monday, December 2nd were given a $0.34 dividend. The ex-dividend date of this dividend was Monday, December 2nd. This represents a $1.36 annualized dividend and a yield of 2.60%. NBT Bancorp's dividend payout ratio (DPR) is 47.89%.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently bought and sold shares of the business. Victory Capital Management Inc. raised its holdings in shares of NBT Bancorp by 540.2% in the second quarter. Victory Capital Management Inc. now owns 703,286 shares of the bank's stock valued at $27,147,000 after buying an additional 593,436 shares during the last quarter. Bank of New York Mellon Corp raised its stake in NBT Bancorp by 36.7% during the 2nd quarter. Bank of New York Mellon Corp now owns 629,715 shares of the bank's stock valued at $24,307,000 after acquiring an additional 169,180 shares during the last quarter. Eagle Asset Management Inc. lifted its position in NBT Bancorp by 76.3% during the 3rd quarter. Eagle Asset Management Inc. now owns 378,898 shares of the bank's stock worth $16,759,000 after acquiring an additional 163,952 shares during the period. Deprince Race & Zollo Inc. grew its stake in shares of NBT Bancorp by 14.9% in the 2nd quarter. Deprince Race & Zollo Inc. now owns 828,440 shares of the bank's stock valued at $31,978,000 after purchasing an additional 107,404 shares during the last quarter. Finally, Ceredex Value Advisors LLC increased its holdings in shares of NBT Bancorp by 40.9% in the third quarter. Ceredex Value Advisors LLC now owns 309,300 shares of the bank's stock valued at $13,680,000 after purchasing an additional 89,800 shares during the period. 58.46% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of equities analysts recently commented on the stock. Keefe, Bruyette & Woods boosted their target price on shares of NBT Bancorp from $50.00 to $55.00 and gave the stock a "market perform" rating in a research note on Wednesday, December 4th. Stephens reaffirmed an "equal weight" rating and set a $49.00 price objective on shares of NBT Bancorp in a research report on Tuesday, September 10th. DA Davidson began coverage on NBT Bancorp in a research report on Thursday, December 12th. They set a "neutral" rating and a $60.00 target price on the stock. Finally, StockNews.com upgraded NBT Bancorp from a "sell" rating to a "hold" rating in a research note on Tuesday, December 10th. Four analysts have rated the stock with a hold rating, two have issued a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, NBT Bancorp presently has a consensus rating of "Moderate Buy" and an average target price of $48.17.

Read Our Latest Research Report on NBTB

About NBT Bancorp

(

Get Free Report)

NBT Bancorp Inc, a financial holding company, provides commercial banking, retail banking, and wealth management services. Its deposit products include demand deposit, savings, negotiable order of withdrawal, money market deposit, and certificate of deposit accounts. The company's loan portfolio comprises indirect and direct consumer, home equity, mortgages, business banking loans, and commercial loans; commercial and industrial, commercial real estate, agricultural, and commercial construction loans; and residential real estate loans.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].