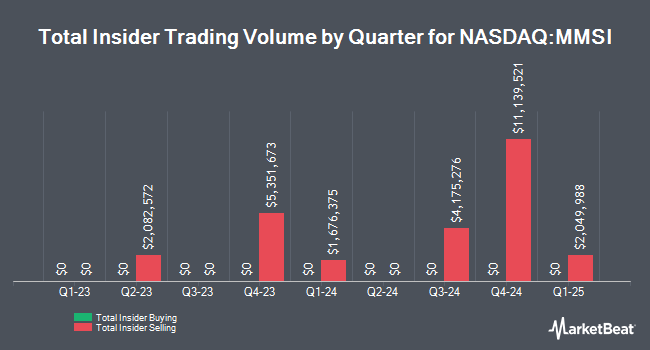

Merit Medical Systems, Inc. (NASDAQ:MMSI - Get Free Report) Director F. Ann Millner sold 12,500 shares of Merit Medical Systems stock in a transaction that occurred on Friday, November 15th. The stock was sold at an average price of $101.55, for a total transaction of $1,269,375.00. Following the sale, the director now owns 32,391 shares of the company's stock, valued at approximately $3,289,306.05. This represents a 27.85 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink.

Merit Medical Systems, Inc. (NASDAQ:MMSI - Get Free Report) Director F. Ann Millner sold 12,500 shares of Merit Medical Systems stock in a transaction that occurred on Friday, November 15th. The stock was sold at an average price of $101.55, for a total transaction of $1,269,375.00. Following the sale, the director now owns 32,391 shares of the company's stock, valued at approximately $3,289,306.05. This represents a 27.85 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink.

Merit Medical Systems Price Performance

MMSI stock opened at $103.94 on Tuesday. The stock has a market cap of $6.06 billion, a PE ratio of 49.92, a price-to-earnings-growth ratio of 2.53 and a beta of 0.89. The stock has a 50-day moving average price of $97.80 and a two-hundred day moving average price of $90.09. Merit Medical Systems, Inc. has a 1 year low of $65.46 and a 1 year high of $105.46. The company has a current ratio of 5.36, a quick ratio of 3.82 and a debt-to-equity ratio of 0.57.

Merit Medical Systems (NASDAQ:MMSI - Get Free Report) last announced its earnings results on Wednesday, October 30th. The medical instruments supplier reported $0.86 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.80 by $0.06. The business had revenue of $339.85 million for the quarter, compared to analyst estimates of $334.60 million. Merit Medical Systems had a return on equity of 15.61% and a net margin of 9.05%. Merit Medical Systems's revenue for the quarter was up 7.8% compared to the same quarter last year. During the same quarter last year, the firm earned $0.75 EPS. Equities analysts forecast that Merit Medical Systems, Inc. will post 3.36 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

Tim Sykes’ Urgent Trade Alert: “Make this move now”

From Timothy Sykes | Ad

WARNING: 80 Wall Street banks are gearing up for MASSIVE D.C. shock

This $2 trillion D.C. shock is NOT about Trump or Biden dropping out of the race…

Click here to see a unique election-year trade

Several research firms have recently issued reports on MMSI. Needham & Company LLC restated a "buy" rating and issued a $109.00 price target on shares of Merit Medical Systems in a research report on Thursday, October 31st. Piper Sandler reiterated an "overweight" rating and issued a $110.00 price target (up from $100.00) on shares of Merit Medical Systems in a research report on Monday, September 9th. Barrington Research restated an "outperform" rating and set a $114.00 price objective on shares of Merit Medical Systems in a report on Thursday, October 31st. StockNews.com lowered shares of Merit Medical Systems from a "buy" rating to a "hold" rating in a report on Sunday, November 3rd. Finally, Bank of America boosted their price target on shares of Merit Medical Systems from $92.00 to $103.00 and gave the company a "neutral" rating in a report on Monday, September 16th. Three investment analysts have rated the stock with a hold rating, nine have given a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $103.36.

Check Out Our Latest Analysis on Merit Medical Systems

Institutional Inflows and Outflows

Several large investors have recently added to or reduced their stakes in MMSI. TD Private Client Wealth LLC boosted its stake in shares of Merit Medical Systems by 13.9% during the 3rd quarter. TD Private Client Wealth LLC now owns 1,732 shares of the medical instruments supplier's stock worth $171,000 after buying an additional 211 shares during the last quarter. Geode Capital Management LLC boosted its position in Merit Medical Systems by 1.3% during the third quarter. Geode Capital Management LLC now owns 1,357,265 shares of the medical instruments supplier's stock valued at $134,165,000 after purchasing an additional 17,490 shares during the last quarter. Barclays PLC increased its position in shares of Merit Medical Systems by 305.4% during the 3rd quarter. Barclays PLC now owns 112,727 shares of the medical instruments supplier's stock worth $11,142,000 after purchasing an additional 84,923 shares during the last quarter. MML Investors Services LLC increased its position in shares of Merit Medical Systems by 8.5% during the 3rd quarter. MML Investors Services LLC now owns 17,690 shares of the medical instruments supplier's stock worth $1,748,000 after purchasing an additional 1,390 shares during the last quarter. Finally, XTX Topco Ltd bought a new stake in shares of Merit Medical Systems during the 3rd quarter worth approximately $465,000. Institutional investors and hedge funds own 99.66% of the company's stock.

About Merit Medical Systems

(

Get Free Report)

Merit Medical Systems, Inc designs, develops, manufactures, and markets single-use medical products for interventional, diagnostic, and therapeutic procedures in the United States and internationally. It operates in two segments, Cardiovascular and Endoscopy. The company provides micropuncture kits, angiographic needles, sheaths, guide wires, and safety products; peripheral intervention, including angiography, drainage, delivery systems, and embolotherapy products; spine products, such as vertebral augmentation, radiofrequency ablation, and bone biopsy systems; oncology products; and cardiac intervention products, such as access, angiography, electrophysiology and cardiac rhythm management, fluid management, hemodynamic monitoring, hemostasis, and intervention to treat various heart conditions.

Read More

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].