Meta Platforms, Inc. (NASDAQ:META - Get Free Report) CEO Mark Zuckerberg sold 35,921 shares of Meta Platforms stock in a transaction dated Friday, December 13th. The shares were sold at an average price of $622.24, for a total transaction of $22,351,483.04. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink.

Meta Platforms, Inc. (NASDAQ:META - Get Free Report) CEO Mark Zuckerberg sold 35,921 shares of Meta Platforms stock in a transaction dated Friday, December 13th. The shares were sold at an average price of $622.24, for a total transaction of $22,351,483.04. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink.

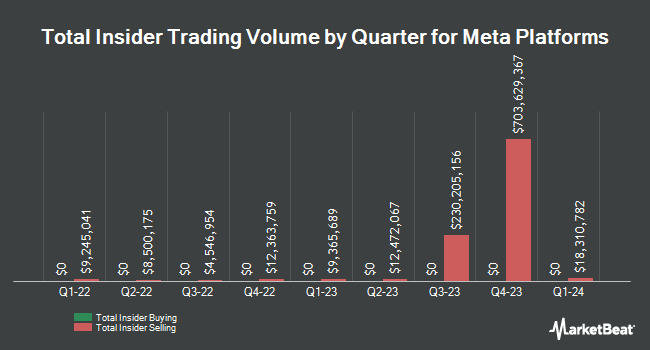

Mark Zuckerberg also recently made the following trade(s):

- On Monday, December 9th, Mark Zuckerberg sold 12,975 shares of Meta Platforms stock. The stock was sold at an average price of $614.36, for a total transaction of $7,971,321.00.

- On Wednesday, December 11th, Mark Zuckerberg sold 35,921 shares of Meta Platforms stock. The shares were sold at an average price of $633.25, for a total value of $22,746,973.25.

- On Friday, December 6th, Mark Zuckerberg sold 22,946 shares of Meta Platforms stock. The shares were sold at an average price of $621.84, for a total value of $14,268,740.64.

- On Tuesday, December 3rd, Mark Zuckerberg sold 35,921 shares of Meta Platforms stock. The stock was sold at an average price of $607.97, for a total value of $21,838,890.37.

- On Wednesday, October 30th, Mark Zuckerberg sold 420 shares of Meta Platforms stock. The shares were sold at an average price of $600.17, for a total value of $252,071.40.

- On Monday, October 14th, Mark Zuckerberg sold 84 shares of Meta Platforms stock. The stock was sold at an average price of $600.00, for a total value of $50,400.00.

- On Monday, October 7th, Mark Zuckerberg sold 492 shares of Meta Platforms stock. The shares were sold at an average price of $600.75, for a total value of $295,569.00.

Meta Platforms Stock Performance

URGENT: This Altcoin Opportunity Won’t Wait – Act Now

From Crypto Swap Profits | Ad

Crypto has officially entered the "banana zone" – that wild phase where prices can 1000x in days.

It happens like clockwork every 4 years, during the December to February window of a Bitcoin halving year.

This is where fortunes are made – often LITERALLY overnight.

>> Register for the Workshop Now

NASDAQ:META opened at $624.24 on Tuesday. The company has a debt-to-equity ratio of 0.18, a quick ratio of 2.73 and a current ratio of 2.73. Meta Platforms, Inc. has a fifty-two week low of $337.02 and a fifty-two week high of $638.40. The firm has a market capitalization of $1.58 trillion, a PE ratio of 29.40, a PEG ratio of 1.39 and a beta of 1.20. The stock's fifty day moving average is $584.76 and its 200 day moving average is $539.38.

Meta Platforms (NASDAQ:META - Get Free Report) last issued its quarterly earnings data on Wednesday, October 30th. The social networking company reported $6.03 EPS for the quarter, topping analysts' consensus estimates of $5.19 by $0.84. The business had revenue of $40.59 billion for the quarter, compared to analysts' expectations of $40.21 billion. Meta Platforms had a net margin of 35.55% and a return on equity of 35.60%. On average, sell-side analysts anticipate that Meta Platforms, Inc. will post 22.68 earnings per share for the current year.

Meta Platforms Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, December 27th. Shareholders of record on Monday, December 16th will be issued a dividend of $0.50 per share. The ex-dividend date is Monday, December 16th. This represents a $2.00 dividend on an annualized basis and a yield of 0.32%. Meta Platforms's dividend payout ratio (DPR) is presently 9.42%.

Institutional Investors Weigh In On Meta Platforms

Institutional investors have recently modified their holdings of the company. JDM Financial Group LLC acquired a new stake in shares of Meta Platforms during the third quarter worth about $30,000. Safe Harbor Fiduciary LLC purchased a new position in shares of Meta Platforms during the 3rd quarter worth $36,000. POM Investment Strategies LLC acquired a new stake in shares of Meta Platforms in the second quarter worth approximately $38,000. Halpern Financial Inc. acquired a new position in Meta Platforms during the third quarter valued at approximately $46,000. Finally, West Financial Advisors LLC purchased a new stake in shares of Meta Platforms in the third quarter worth about $49,000. 79.91% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several research analysts have weighed in on META shares. Piper Sandler upped their price objective on shares of Meta Platforms from $650.00 to $670.00 and gave the company an "overweight" rating in a research note on Tuesday, December 10th. TD Cowen boosted their price objective on Meta Platforms from $600.00 to $675.00 and gave the stock a "buy" rating in a research report on Thursday, October 17th. Robert W. Baird upped their price target on Meta Platforms from $605.00 to $630.00 and gave the stock an "outperform" rating in a research note on Thursday, October 31st. Sanford C. Bernstein raised their target price on Meta Platforms from $600.00 to $675.00 and gave the company an "outperform" rating in a research report on Friday, October 25th. Finally, Rosenblatt Securities restated a "buy" rating and issued a $811.00 target price on shares of Meta Platforms in a research note on Thursday, October 31st. Two analysts have rated the stock with a sell rating, four have assigned a hold rating, thirty-five have issued a buy rating and two have issued a strong buy rating to the company. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $635.20.

Read Our Latest Research Report on Meta Platforms

Meta Platforms Company Profile

(

Get Free Report)

Meta Platforms, Inc engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets, and wearables worldwide. It operates in two segments, Family of Apps and Reality Labs. The Family of Apps segment offers Facebook, which enables people to share, discuss, discover, and connect with interests; Instagram, a community for sharing photos, videos, and private messages, as well as feed, stories, reels, video, live, and shops; Messenger, a messaging application for people to connect with friends, family, communities, and businesses across platforms and devices through text, audio, and video calls; and WhatsApp, a messaging application that is used by people and businesses to communicate and transact privately.

Further Reading

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].