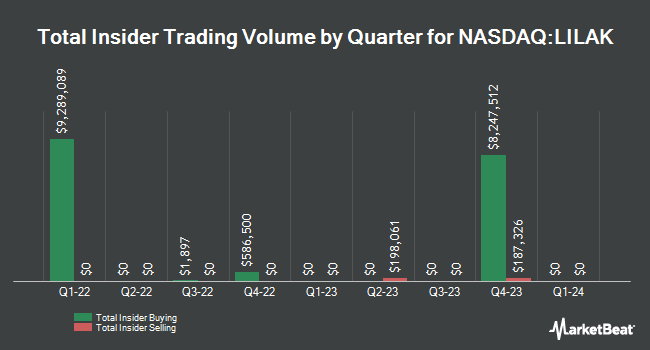

Liberty Latin America Ltd. (NASDAQ:LILAK - Get Free Report) Director Brendan J. Paddick acquired 31,514 shares of the firm's stock in a transaction dated Wednesday, December 4th. The stock was bought at an average price of $6.71 per share, with a total value of $211,458.94. Following the completion of the acquisition, the director now directly owns 1,940,094 shares of the company's stock, valued at approximately $13,018,030.74. This represents a 1.65 % increase in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this link.

Liberty Latin America Ltd. (NASDAQ:LILAK - Get Free Report) Director Brendan J. Paddick acquired 31,514 shares of the firm's stock in a transaction dated Wednesday, December 4th. The stock was bought at an average price of $6.71 per share, with a total value of $211,458.94. Following the completion of the acquisition, the director now directly owns 1,940,094 shares of the company's stock, valued at approximately $13,018,030.74. This represents a 1.65 % increase in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this link.

Liberty Latin America Stock Down 2.0 %

Shares of NASDAQ:LILAK opened at $6.81 on Thursday. Liberty Latin America Ltd. has a 1-year low of $5.95 and a 1-year high of $10.93. The company has a debt-to-equity ratio of 4.31, a quick ratio of 1.06 and a current ratio of 1.06. The company has a 50 day moving average price of $8.59 and a 200 day moving average price of $9.09.

Institutional Trading of Liberty Latin America

Large investors have recently added to or reduced their stakes in the business. Vanguard Group Inc. boosted its stake in Liberty Latin America by 6.4% in the 1st quarter. Vanguard Group Inc. now owns 3,271,414 shares of the company's stock worth $22,867,000 after purchasing an additional 197,988 shares during the period. Price T Rowe Associates Inc. MD boosted its stake in Liberty Latin America by 4.2% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 110,116 shares of the company's stock worth $770,000 after purchasing an additional 4,487 shares during the period. Genesis Investment Management LLP boosted its stake in Liberty Latin America by 39.4% in the 2nd quarter. Genesis Investment Management LLP now owns 2,609,237 shares of the company's stock worth $25,101,000 after purchasing an additional 737,883 shares during the period. Timber Creek Capital Management LLC boosted its stake in Liberty Latin America by 20.6% in the 2nd quarter. Timber Creek Capital Management LLC now owns 314,367 shares of the company's stock worth $3,024,000 after purchasing an additional 53,744 shares during the period. Finally, Bay Colony Advisory Group Inc d b a Bay Colony Advisors boosted its stake in Liberty Latin America by 29.9% in the 2nd quarter. Bay Colony Advisory Group Inc d b a Bay Colony Advisors now owns 13,691 shares of the company's stock worth $132,000 after purchasing an additional 3,150 shares during the period. 52.98% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

This Crypto Is Set to Explode in December

From Crypto 101 Media | Ad

It's a groundbreaking opportunity that could be poised for extraordinary gains.

The catalyst behind this surge is a massive new blockchain development…

YES, I WANT THE #1 CRYPTO NOW

LILAK has been the subject of several recent analyst reports. StockNews.com cut shares of Liberty Latin America from a "buy" rating to a "hold" rating in a report on Thursday, August 15th. The Goldman Sachs Group decreased their price objective on shares of Liberty Latin America from $10.50 to $7.50 and set a "neutral" rating for the company in a report on Wednesday. Scotiabank decreased their price objective on shares of Liberty Latin America from $9.40 to $8.30 and set a "sector outperform" rating for the company in a report on Friday, November 8th. Finally, Pivotal Research reduced their target price on shares of Liberty Latin America from $18.00 to $15.00 and set a "buy" rating for the company in a report on Monday, August 12th.

Read Our Latest Analysis on Liberty Latin America

About Liberty Latin America

(

Get Free Report)

Liberty Latin America Ltd., together with its subsidiaries, provides fixed, mobile, and subsea telecommunications services. The company operates through C&W Caribbean, C&W Panama, Liberty Networks, Liberty Puerto Rico, and Liberty Costa Rico segments. It offers communications and entertainment services, including video, broadband internet, fixed-line, telephony, and mobiles services to residential and business customers; and business products and services that include enterprise-grade connectivity, data center, hosting, and managed solutions, as well as information technology solutions for small and medium enterprises, international companies, and governmental agencies.

Further Reading

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].