Legacy Housing Co. (NASDAQ:LEGH - Get Free Report) Chairman Curtis Drew Hodgson sold 500 shares of the firm's stock in a transaction that occurred on Wednesday, November 13th. The shares were sold at an average price of $27.31, for a total transaction of $13,655.00. Following the sale, the chairman now directly owns 525,822 shares of the company's stock, valued at $14,360,198.82. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link.

Legacy Housing Co. (NASDAQ:LEGH - Get Free Report) Chairman Curtis Drew Hodgson sold 500 shares of the firm's stock in a transaction that occurred on Wednesday, November 13th. The shares were sold at an average price of $27.31, for a total transaction of $13,655.00. Following the sale, the chairman now directly owns 525,822 shares of the company's stock, valued at $14,360,198.82. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link.

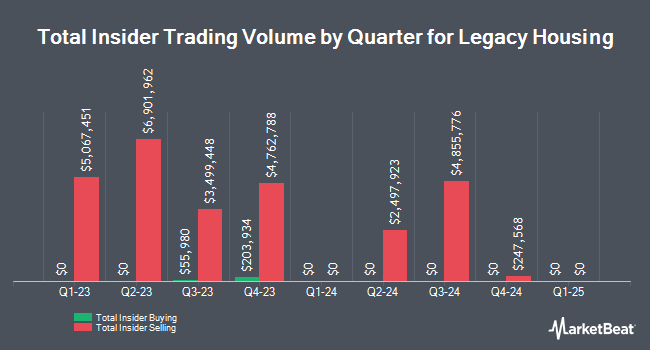

Curtis Drew Hodgson also recently made the following trade(s):

- On Monday, November 11th, Curtis Drew Hodgson sold 16,268 shares of Legacy Housing stock. The shares were sold at an average price of $27.52, for a total value of $447,695.36.

- On Monday, November 4th, Curtis Drew Hodgson sold 7,700 shares of Legacy Housing stock. The stock was sold at an average price of $25.57, for a total transaction of $196,889.00.

- On Monday, October 28th, Curtis Drew Hodgson sold 17,300 shares of Legacy Housing stock. The stock was sold at an average price of $25.20, for a total value of $435,960.00.

- On Monday, October 21st, Curtis Drew Hodgson sold 1,300 shares of Legacy Housing stock. The shares were sold at an average price of $27.02, for a total value of $35,126.00.

- On Monday, October 14th, Curtis Drew Hodgson sold 17,300 shares of Legacy Housing stock. The stock was sold at an average price of $26.42, for a total transaction of $457,066.00.

- On Friday, October 11th, Curtis Drew Hodgson sold 9,180 shares of Legacy Housing stock. The shares were sold at an average price of $26.27, for a total transaction of $241,158.60.

- On Wednesday, October 9th, Curtis Drew Hodgson sold 5,288 shares of Legacy Housing stock. The shares were sold at an average price of $26.29, for a total value of $139,021.52.

- On Monday, October 7th, Curtis Drew Hodgson sold 499 shares of Legacy Housing stock. The shares were sold at an average price of $26.27, for a total transaction of $13,108.73.

- On Monday, September 30th, Curtis Drew Hodgson sold 17,300 shares of Legacy Housing stock. The stock was sold at an average price of $27.27, for a total value of $471,771.00.

- On Friday, September 27th, Curtis Drew Hodgson sold 1,311 shares of Legacy Housing stock. The shares were sold at an average price of $27.71, for a total transaction of $36,327.81.

Legacy Housing Stock Performance

Watch this before it gets removed

From Porter & Company | Ad

If you missed it, my emergency election broadcast is now available - but will be removed soon

Click here to watch it now.

NASDAQ:LEGH opened at $26.24 on Thursday. The firm has a market cap of $633.91 million, a price-to-earnings ratio of 12.09 and a beta of 1.09. The company has a debt-to-equity ratio of 0.03, a current ratio of 4.39 and a quick ratio of 3.41. Legacy Housing Co. has a 1-year low of $19.42 and a 1-year high of $29.31. The firm's fifty day moving average price is $26.68 and its 200 day moving average price is $25.14.

Legacy Housing (NASDAQ:LEGH - Get Free Report) last posted its quarterly earnings results on Tuesday, November 12th. The company reported $0.64 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.65 by ($0.01). Legacy Housing had a net margin of 33.11% and a return on equity of 12.04%. The company had revenue of $44.27 million for the quarter, compared to analyst estimates of $51.14 million. On average, sell-side analysts expect that Legacy Housing Co. will post 2.55 EPS for the current year.

Analysts Set New Price Targets

Several research firms have recently weighed in on LEGH. B. Riley restated a "neutral" rating and set a $29.00 price target (up previously from $25.00) on shares of Legacy Housing in a report on Monday, August 12th. Wedbush restated an "outperform" rating and issued a $29.00 price objective on shares of Legacy Housing in a report on Friday, August 9th.

Check Out Our Latest Research Report on Legacy Housing

Institutional Trading of Legacy Housing

Several large investors have recently modified their holdings of the business. SG Capital Management LLC purchased a new position in shares of Legacy Housing during the first quarter valued at approximately $1,532,000. Vanguard Group Inc. grew its stake in Legacy Housing by 5.2% during the first quarter. Vanguard Group Inc. now owns 441,383 shares of the company's stock worth $9,499,000 after buying an additional 21,995 shares during the period. Progeny 3 Inc. acquired a new stake in Legacy Housing in the 2nd quarter valued at $1,019,000. Renaissance Technologies LLC grew its stake in shares of Legacy Housing by 161.0% in the second quarter. Renaissance Technologies LLC now owns 40,200 shares of the company's stock valued at $922,000 after buying an additional 24,800 shares in the last quarter. Finally, Assenagon Asset Management S.A. acquired a new position in shares of Legacy Housing during the third quarter worth $365,000. 89.35% of the stock is currently owned by institutional investors and hedge funds.

About Legacy Housing

(

Get Free Report)

Legacy Housing Corporation engages in the building, sale, and financing of manufactured homes and tiny houses primarily in the southern United States. It manufactures and provides for the transport of mobile homes, including 1 to 5 bedrooms with 1 to 3 1/2 bathrooms; and provides wholesale financing to dealers and mobile home parks, as well as retail financing to consumers.

See Also

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].