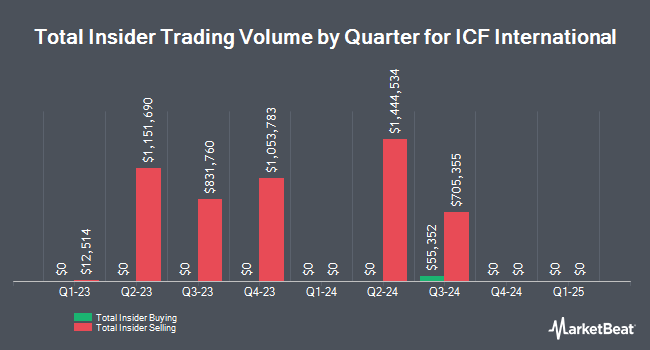

ICF International, Inc. (NASDAQ:ICFI - Get Free Report) CEO John Wasson sold 100 shares of the firm's stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $180.00, for a total transaction of $18,000.00. Following the completion of the sale, the chief executive officer now owns 68,718 shares in the company, valued at approximately $12,369,240. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this link.

ICF International, Inc. (NASDAQ:ICFI - Get Free Report) CEO John Wasson sold 100 shares of the firm's stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $180.00, for a total transaction of $18,000.00. Following the completion of the sale, the chief executive officer now owns 68,718 shares in the company, valued at approximately $12,369,240. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this link.

John Wasson also recently made the following trade(s):

- On Thursday, August 29th, John Wasson sold 1,417 shares of ICF International stock. The shares were sold at an average price of $165.14, for a total transaction of $234,003.38.

ICF International Stock Performance

NASDAQ:ICFI opened at $168.75 on Friday. The company has a fifty day moving average of $167.47 and a 200-day moving average of $153.49. The firm has a market capitalization of $3.17 billion, a P/E ratio of 29.66 and a beta of 0.61. The company has a quick ratio of 1.19, a current ratio of 1.21 and a debt-to-equity ratio of 0.43. ICF International, Inc. has a twelve month low of $128.28 and a twelve month high of $179.67.

The centerpiece of Trump’s crypto’s masterplan …

From Weiss Ratings | Ad

Donald Trump wants to be America’s first crypto president.

He was the keynote speaker at the recent Bitcoin conference in Nashville …

Where he told an adoring crowd that the U.S. would become …

“The crypto capital of the planet and the Bitcoin superpower of the world.”

Click here to find out more about what could be Trump and JD Vance’s favorite coin.

ICF International (NASDAQ:ICFI - Get Free Report) last released its quarterly earnings data on Friday, November 1st. The business services provider reported $2.13 earnings per share for the quarter, beating the consensus estimate of $1.77 by $0.36. ICF International had a net margin of 5.38% and a return on equity of 14.68%. The company had revenue of $517.00 million during the quarter, compared to analyst estimates of $528.02 million. During the same quarter in the previous year, the business posted $1.81 EPS. ICF International's revenue for the quarter was up 3.1% compared to the same quarter last year. As a group, sell-side analysts anticipate that ICF International, Inc. will post 7.45 EPS for the current year.

ICF International Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, January 10th. Investors of record on Friday, December 6th will be given a $0.14 dividend. This represents a $0.56 annualized dividend and a yield of 0.33%. The ex-dividend date is Friday, December 6th. ICF International's payout ratio is currently 9.84%.

Analyst Upgrades and Downgrades

Several equities research analysts recently commented on the stock. Truist Financial lifted their target price on shares of ICF International from $155.00 to $180.00 and gave the stock a "hold" rating in a research report on Friday, November 1st. Barrington Research reiterated an "outperform" rating and set a $174.00 target price on shares of ICF International in a research report on Friday, September 20th. Two analysts have rated the stock with a hold rating and three have given a buy rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus price target of $166.00.

Read Our Latest Stock Analysis on ICFI

Institutional Trading of ICF International

Several hedge funds have recently bought and sold shares of the business. Zions Bancorporation N.A. boosted its holdings in ICF International by 17.4% during the 3rd quarter. Zions Bancorporation N.A. now owns 15,994 shares of the business services provider's stock worth $2,668,000 after acquiring an additional 2,368 shares during the last quarter. Chartwell Investment Partners LLC boosted its holdings in ICF International by 0.8% during the 3rd quarter. Chartwell Investment Partners LLC now owns 8,255 shares of the business services provider's stock worth $1,377,000 after acquiring an additional 67 shares during the last quarter. Farther Finance Advisors LLC boosted its holdings in ICF International by 13.1% during the 3rd quarter. Farther Finance Advisors LLC now owns 502 shares of the business services provider's stock worth $84,000 after acquiring an additional 58 shares during the last quarter. Congress Asset Management Co. boosted its holdings in ICF International by 10.7% during the 3rd quarter. Congress Asset Management Co. now owns 353,824 shares of the business services provider's stock worth $59,014,000 after acquiring an additional 34,299 shares during the last quarter. Finally, Argent Capital Management LLC boosted its holdings in ICF International by 5.3% during the 3rd quarter. Argent Capital Management LLC now owns 28,880 shares of the business services provider's stock worth $4,817,000 after acquiring an additional 1,462 shares during the last quarter. Institutional investors and hedge funds own 94.12% of the company's stock.

ICF International Company Profile

(

Get Free Report)

ICF International, Inc provides management, technology, and policy consulting and implementation services to government and commercial clients in the United States and internationally. The company researches critical policy, industry, stakeholder issues, trends, and behaviors; measures and evaluates results and their impact; and provides strategic planning and advisory services to its clients on how to navigate societal, business, market, business, communication, and technology challenges.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].