Hope Bancorp, Inc. (NASDAQ:HOPE - Get Free Report) EVP Thomas Stenger sold 1,250 shares of the company's stock in a transaction dated Wednesday, November 6th. The shares were sold at an average price of $12.50, for a total transaction of $15,625.00. Following the transaction, the executive vice president now owns 24,702 shares in the company, valued at $308,775. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website.

Hope Bancorp, Inc. (NASDAQ:HOPE - Get Free Report) EVP Thomas Stenger sold 1,250 shares of the company's stock in a transaction dated Wednesday, November 6th. The shares were sold at an average price of $12.50, for a total transaction of $15,625.00. Following the transaction, the executive vice president now owns 24,702 shares in the company, valued at $308,775. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website.

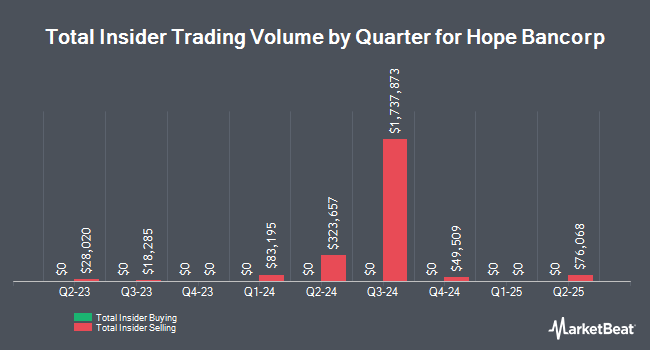

Thomas Stenger also recently made the following trade(s):

- On Friday, August 16th, Thomas Stenger sold 3,200 shares of Hope Bancorp stock. The shares were sold at an average price of $12.40, for a total transaction of $39,680.00.

Hope Bancorp Price Performance

NASDAQ HOPE opened at $13.52 on Friday. Hope Bancorp, Inc. has a 52 week low of $9.02 and a 52 week high of $14.53. The firm has a market capitalization of $1.63 billion, a P/E ratio of 16.10 and a beta of 1.13. The company has a quick ratio of 0.95, a current ratio of 0.96 and a debt-to-equity ratio of 0.10. The company has a 50-day moving average price of $12.61 and a 200-day moving average price of $11.70.

Watch this before it gets removed

From Porter & Company | Ad

If you missed it, my emergency election broadcast is now available - but will be removed soon

Click here to watch it now.

Hope Bancorp (NASDAQ:HOPE - Get Free Report) last released its earnings results on Monday, October 28th. The financial services provider reported $0.21 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.22 by ($0.01). The firm had revenue of $246.92 million during the quarter, compared to analysts' expectations of $121.67 million. Hope Bancorp had a return on equity of 5.52% and a net margin of 9.81%. During the same period in the prior year, the company posted $0.25 earnings per share. Equities research analysts anticipate that Hope Bancorp, Inc. will post 0.85 earnings per share for the current year.

Hope Bancorp Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, November 21st. Investors of record on Thursday, November 7th will be issued a $0.14 dividend. This represents a $0.56 annualized dividend and a yield of 4.14%. The ex-dividend date of this dividend is Thursday, November 7th. Hope Bancorp's dividend payout ratio is 66.67%.

Institutional Investors Weigh In On Hope Bancorp

Hedge funds and other institutional investors have recently added to or reduced their stakes in the company. nVerses Capital LLC purchased a new stake in Hope Bancorp in the 3rd quarter worth approximately $48,000. SageView Advisory Group LLC purchased a new stake in Hope Bancorp during the 1st quarter valued at approximately $49,000. Fifth Third Bancorp grew its holdings in Hope Bancorp by 149.5% during the 2nd quarter. Fifth Third Bancorp now owns 5,279 shares of the financial services provider's stock valued at $57,000 after buying an additional 3,163 shares in the last quarter. CWM LLC grew its holdings in Hope Bancorp by 15.7% during the 3rd quarter. CWM LLC now owns 9,109 shares of the financial services provider's stock valued at $114,000 after buying an additional 1,238 shares in the last quarter. Finally, Choreo LLC purchased a new stake in Hope Bancorp during the 2nd quarter valued at approximately $108,000. 84.00% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several equities analysts have issued reports on HOPE shares. Keefe, Bruyette & Woods upped their target price on shares of Hope Bancorp from $12.00 to $14.00 and gave the company a "market perform" rating in a research note on Tuesday, July 30th. StockNews.com cut shares of Hope Bancorp from a "hold" rating to a "sell" rating in a research note on Tuesday, October 29th.

View Our Latest Research Report on HOPE

Hope Bancorp Company Profile

(

Get Free Report)

Hope Bancorp, Inc operates as the bank holding company for Bank of Hope that provides retail and commercial banking services for businesses and individuals in the United States. It accepts personal and business checking, money market, savings, time deposit, and individual retirement accounts. The company also offers loans comprising commercial and industrial loans to businesses for various purposes, such as working capital, purchasing inventory, debt refinancing, business acquisitions, international trade finance, other business-related financing, and loans syndication services; commercial real estate loans; residential mortgage loans; small business administration loans; and consumer loans, such as single-family mortgage, home equity, automobile, credit card, and personal loans.

See Also

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].