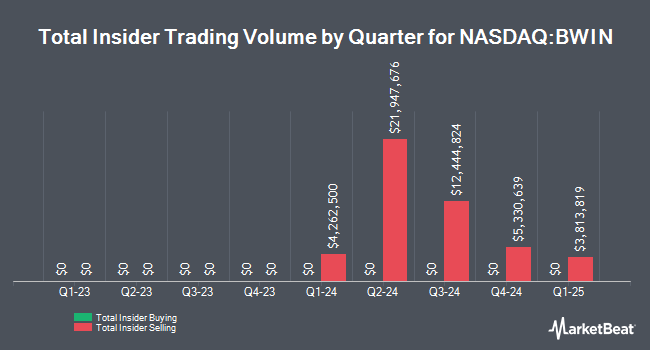

The Baldwin Insurance Group, Inc. (NASDAQ:BWIN - Get Free Report) major shareholder Elizabeth Krystyn sold 88,306 shares of the stock in a transaction on Wednesday, December 11th. The shares were sold at an average price of $43.05, for a total transaction of $3,801,573.30. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Major shareholders that own more than 10% of a company's shares are required to disclose their sales and purchases with the SEC.

The Baldwin Insurance Group, Inc. (NASDAQ:BWIN - Get Free Report) major shareholder Elizabeth Krystyn sold 88,306 shares of the stock in a transaction on Wednesday, December 11th. The shares were sold at an average price of $43.05, for a total transaction of $3,801,573.30. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Major shareholders that own more than 10% of a company's shares are required to disclose their sales and purchases with the SEC.

Elizabeth Krystyn also recently made the following trade(s):

- On Monday, December 9th, Elizabeth Krystyn sold 191,307 shares of The Baldwin Insurance Group stock. The stock was sold at an average price of $45.18, for a total value of $8,643,250.26.

The Baldwin Insurance Group Price Performance

Shares of BWIN opened at $42.86 on Thursday. The stock has a market cap of $5.04 billion, a P/E ratio of -66.97, a price-to-earnings-growth ratio of 1.40 and a beta of 1.58. The Baldwin Insurance Group, Inc. has a 1 year low of $20.00 and a 1 year high of $55.82. The stock's 50-day moving average price is $48.36 and its two-hundred day moving average price is $43.61. The company has a current ratio of 0.98, a quick ratio of 0.98 and a debt-to-equity ratio of 1.35.

Do this Before Elon’s Reveal on January 22nd

From Brownstone Research | Ad

Elon’s newest tech could pay you an extra $30,000 a year — while you sleep.

It’s smaller than a quarter but designed to power a $9 trillion AI revolution.

And I’ve identified a little-known supplier Elon is depending on to make it all happen.

I urge you to watch this video now.

The Baldwin Insurance Group (NASDAQ:BWIN - Get Free Report) last announced its quarterly earnings results on Monday, November 4th. The company reported $0.33 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.34 by ($0.01). The firm had revenue of $339.90 million during the quarter, compared to analyst estimates of $346.43 million. The Baldwin Insurance Group had a negative net margin of 2.89% and a positive return on equity of 10.57%. The Baldwin Insurance Group's quarterly revenue was up 11.0% on a year-over-year basis. During the same period last year, the firm earned $0.15 EPS. On average, equities analysts predict that The Baldwin Insurance Group, Inc. will post 1.01 earnings per share for the current year.

Wall Street Analysts Forecast Growth

Several analysts have weighed in on BWIN shares. Wells Fargo & Company reaffirmed an "underweight" rating and set a $41.00 price objective (down from $43.00) on shares of The Baldwin Insurance Group in a research note on Wednesday. Jefferies Financial Group raised their price target on The Baldwin Insurance Group from $38.00 to $46.00 and gave the company a "hold" rating in a report on Wednesday, October 9th. JPMorgan Chase & Co. lifted their price objective on The Baldwin Insurance Group from $45.00 to $54.00 and gave the company an "overweight" rating in a research report on Thursday, October 10th. Finally, William Blair upgraded The Baldwin Insurance Group from a "market perform" rating to an "outperform" rating in a report on Thursday, October 17th. One investment analyst has rated the stock with a sell rating, one has issued a hold rating, four have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $46.83.

Check Out Our Latest Research Report on The Baldwin Insurance Group

About The Baldwin Insurance Group

(

Get Free Report)

The Baldwin Insurance Group, Inc operates as an independent insurance distribution firm that delivers insurance and risk management solutions in the United States. It operates through three segments: Insurance Advisory Solutions; Underwriting, Capacity & Technology Solutions; and Mainstreet Insurance Solutions.

See Also

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].