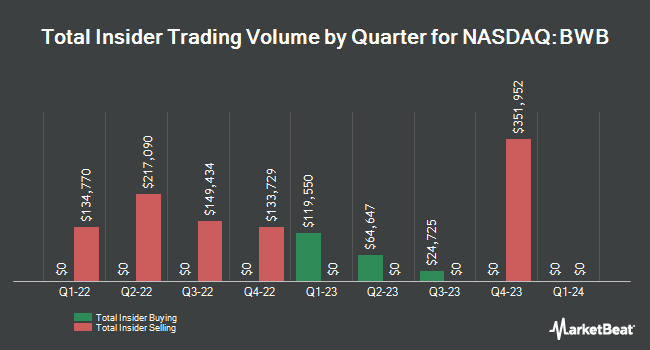

Bridgewater Bancshares, Inc. (NASDAQ:BWB - Get Free Report) Director James S. Johnson sold 4,705 shares of the company's stock in a transaction on Thursday, November 21st. The shares were sold at an average price of $15.00, for a total value of $70,575.00. Following the completion of the transaction, the director now directly owns 93,646 shares in the company, valued at $1,404,690. This trade represents a 4.78 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this link.

Bridgewater Bancshares, Inc. (NASDAQ:BWB - Get Free Report) Director James S. Johnson sold 4,705 shares of the company's stock in a transaction on Thursday, November 21st. The shares were sold at an average price of $15.00, for a total value of $70,575.00. Following the completion of the transaction, the director now directly owns 93,646 shares in the company, valued at $1,404,690. This trade represents a 4.78 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this link.

Bridgewater Bancshares Price Performance

BWB opened at $15.06 on Friday. The company has a market capitalization of $413.10 million, a price-to-earnings ratio of 14.34 and a beta of 0.67. The company has a current ratio of 1.02, a quick ratio of 1.02 and a debt-to-equity ratio of 1.11. Bridgewater Bancshares, Inc. has a 12-month low of $10.18 and a 12-month high of $16.00. The business's fifty day simple moving average is $14.64 and its 200-day simple moving average is $13.20.

Analyst Ratings Changes

BWB has been the topic of a number of research analyst reports. DA Davidson upped their price target on shares of Bridgewater Bancshares from $14.00 to $17.00 and gave the stock a "buy" rating in a report on Friday, July 26th. Piper Sandler upped their target price on shares of Bridgewater Bancshares from $13.00 to $17.00 and gave the stock an "overweight" rating in a research note on Monday, July 29th.

“Fed Proof” Your Bank Account with THESE 4 Simple Steps

From Weiss Ratings | Ad

Starting as soon as a few months from now, the United States government will make a sweeping change to bank accounts nationwide.

It will give them unprecedented powers to control your bank account.

Learn these 4 simple steps and protect your savings before it’s too late.

Check Out Our Latest Research Report on BWB

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently added to or reduced their stakes in BWB. Northwestern Mutual Wealth Management Co. bought a new stake in Bridgewater Bancshares during the 2nd quarter valued at $35,000. BNP Paribas Financial Markets boosted its position in Bridgewater Bancshares by 18.0% during the third quarter. BNP Paribas Financial Markets now owns 4,424 shares of the company's stock valued at $63,000 after purchasing an additional 676 shares in the last quarter. SG Americas Securities LLC purchased a new position in Bridgewater Bancshares in the third quarter valued at about $100,000. Sei Investments Co. raised its holdings in Bridgewater Bancshares by 23.3% in the second quarter. Sei Investments Co. now owns 14,360 shares of the company's stock worth $167,000 after purchasing an additional 2,713 shares in the last quarter. Finally, D.A. Davidson & CO. purchased a new stake in shares of Bridgewater Bancshares during the third quarter valued at about $183,000. 65.83% of the stock is currently owned by institutional investors.

About Bridgewater Bancshares

(

Get Free Report)

Bridgewater Bancshares, Inc operates as the bank holding company for Bridgewater Bank that provides banking products and services to commercial real estate investors, entrepreneurs, business clients, and individuals in the United States. The company provides savings and money market accounts, demand deposits, time and brokered deposits, and interest and noninterest bearing transaction, as well as certificates of deposit.

See Also

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].