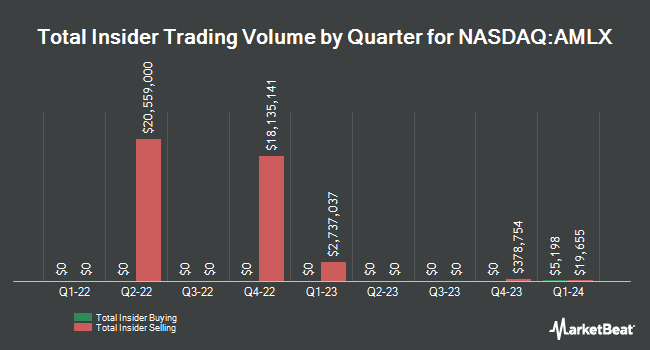

Amylyx Pharmaceuticals, Inc. (NASDAQ:AMLX - Get Free Report) Director Bernhardt G. Zeiher purchased 10,000 shares of the business's stock in a transaction on Thursday, March 20th. The shares were acquired at an average price of $3.70 per share, with a total value of $37,000.00. Following the completion of the transaction, the director now owns 10,000 shares of the company's stock, valued at approximately $37,000. This trade represents a ∞ increase in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink.

Amylyx Pharmaceuticals, Inc. (NASDAQ:AMLX - Get Free Report) Director Bernhardt G. Zeiher purchased 10,000 shares of the business's stock in a transaction on Thursday, March 20th. The shares were acquired at an average price of $3.70 per share, with a total value of $37,000.00. Following the completion of the transaction, the director now owns 10,000 shares of the company's stock, valued at approximately $37,000. This trade represents a ∞ increase in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink.

Amylyx Pharmaceuticals Stock Performance

AMLX stock opened at $3.78 on Tuesday. The business's 50 day moving average price is $3.52 and its two-hundred day moving average price is $4.01. The company has a market capitalization of $334.92 million, a price-to-earnings ratio of -0.99 and a beta of -0.51. Amylyx Pharmaceuticals, Inc. has a fifty-two week low of $1.58 and a fifty-two week high of $7.27.

Amylyx Pharmaceuticals (NASDAQ:AMLX - Get Free Report) last issued its quarterly earnings results on Tuesday, March 4th. The company reported ($0.55) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.49) by ($0.06). The company had revenue of ($0.67) million for the quarter. Sell-side analysts forecast that Amylyx Pharmaceuticals, Inc. will post -2.2 earnings per share for the current year.

Institutional Trading of Amylyx Pharmaceuticals

Hedge funds have recently made changes to their positions in the stock. Blue Trust Inc. boosted its stake in Amylyx Pharmaceuticals by 232.1% in the 4th quarter. Blue Trust Inc. now owns 6,987 shares of the company's stock worth $26,000 after purchasing an additional 4,883 shares in the last quarter. Fox Run Management L.L.C. purchased a new position in Amylyx Pharmaceuticals in the 4th quarter worth approximately $45,000. Alpine Global Management LLC bought a new position in Amylyx Pharmaceuticals in the 4th quarter valued at approximately $45,000. RPO LLC purchased a new stake in Amylyx Pharmaceuticals during the 4th quarter valued at $46,000. Finally, EntryPoint Capital LLC bought a new stake in shares of Amylyx Pharmaceuticals in the 4th quarter worth $53,000. 95.84% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

Separately, HC Wainwright reiterated a "buy" rating and issued a $12.00 price objective on shares of Amylyx Pharmaceuticals in a research report on Wednesday, March 5th. Three research analysts have rated the stock with a hold rating, three have assigned a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $7.33.

Get Our Latest Research Report on AMLX

About Amylyx Pharmaceuticals

(

Get Free Report)

Amylyx Pharmaceuticals, Inc, a commercial-stage biotechnology company, engages in the discovery and development of treatment for amyotrophic lateral sclerosis (ALS) and neurodegenerative diseases. The company's products include RELYVRIO, a dual UPR-Bax apoptosis inhibitor composed of sodium phenylbutyrate and taurursodiol for the treatment of ALS in adults in the United States and marketed as ALBRIOZA for the treatment of ALS in Canada.

See Also

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to contact@insidertrades.com.