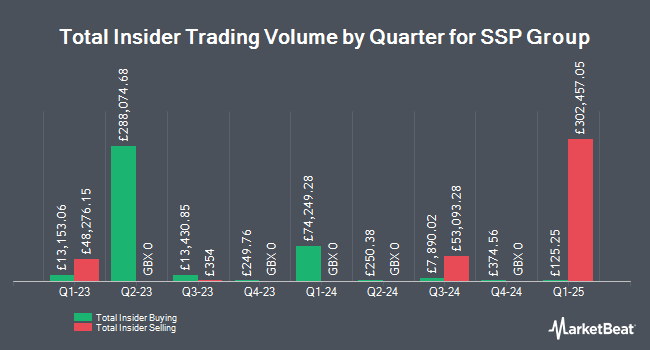

SSP Group plc (LON:SSPG - Get Free Report) insider Jonathan Davies purchased 71 shares of the company's stock in a transaction that occurred on Monday, January 6th. The stock was bought at an average cost of GBX 176 ($2.20) per share, with a total value of £124.96 ($155.89).

SSP Group plc (LON:SSPG - Get Free Report) insider Jonathan Davies purchased 71 shares of the company's stock in a transaction that occurred on Monday, January 6th. The stock was bought at an average cost of GBX 176 ($2.20) per share, with a total value of £124.96 ($155.89).

Jonathan Davies also recently made the following trade(s):

- On Friday, December 6th, Jonathan Davies bought 67 shares of SSP Group stock. The stock was purchased at an average cost of GBX 186 ($2.32) per share, for a total transaction of £124.62 ($155.46).

- On Wednesday, November 6th, Jonathan Davies bought 78 shares of SSP Group stock. The stock was purchased at an average price of GBX 161 ($2.01) per share, with a total value of £125.58 ($156.66).

SSP Group Price Performance

SSPG stock opened at GBX 175.30 ($2.19) on Wednesday. The stock has a market cap of £1.40 billion, a price-to-earnings ratio of 17,530.00, a P/E/G ratio of -0.77 and a beta of 1.88. The company has a debt-to-equity ratio of 595.27, a current ratio of 0.35 and a quick ratio of 0.66. The company has a 50 day simple moving average of GBX 170.43 and a 200 day simple moving average of GBX 167.21. SSP Group plc has a 1 year low of GBX 142.20 ($1.77) and a 1 year high of GBX 235 ($2.93).

SSP Group Increases Dividend

The company also recently declared a dividend, which will be paid on Thursday, February 27th. Stockholders of record on Thursday, January 30th will be paid a GBX 2.30 ($0.03) dividend. This represents a dividend yield of 1.42%. This is a boost from SSP Group's previous dividend of $1.20. The ex-dividend date is Thursday, January 30th. SSP Group's dividend payout ratio is presently 20,000.00%.

Analysts Set New Price Targets

Vladimir Lenin was right…

From Porter & Company | Ad

The Magnificent 7 could be in for a world of pain…

And the insiders know it. It’s why Jeff Bezos just sold $3 billion of Amazon… it’s why Nvidia’s CEO just sold $713 million... and it’s why Zuckerberg just sold $1.3 billion in Meta stock.

The financial establishment doesn’t want you to know about this… but a controversial new documentary just pulled back the curtain and exposed what’s really going on.

It’s called The Final Frontier.

Including the name of the #1 company to buy.

A number of research analysts recently issued reports on the stock. Shore Capital reissued a "house stock" rating on shares of SSP Group in a research note on Wednesday, December 4th. Berenberg Bank reiterated a "hold" rating and issued a GBX 180 ($2.25) price target on shares of SSP Group in a research note on Wednesday, October 16th. Finally, JPMorgan Chase & Co. boosted their price target on SSP Group from GBX 200 ($2.50) to GBX 210 ($2.62) and gave the stock a "neutral" rating in a report on Thursday, December 12th. Two analysts have rated the stock with a hold rating and two have issued a buy rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of GBX 246.25 ($3.07).

Check Out Our Latest Stock Report on SSP Group

About SSP Group

(

Get Free Report)

SSP is a leading operator of food and beverage outlets in travel locations worldwide, with c.37,000 colleagues in over 600 locations across 36 countries. We operate sit-down and quick service restaurants, cafes, lounges and food-led convenience stores, principally in airports and train stations, with a portfolio of more than 550 international, national and local brands.

Read More

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].