National Grid plc (LON:NG - Get Free Report) insider John Pettigrew purchased 15 shares of National Grid stock in a transaction that occurred on Thursday, November 7th. The stock was acquired at an average price of GBX 992 ($12.91) per share, for a total transaction of £148.80 ($193.70).

National Grid plc (LON:NG - Get Free Report) insider John Pettigrew purchased 15 shares of National Grid stock in a transaction that occurred on Thursday, November 7th. The stock was acquired at an average price of GBX 992 ($12.91) per share, for a total transaction of £148.80 ($193.70).

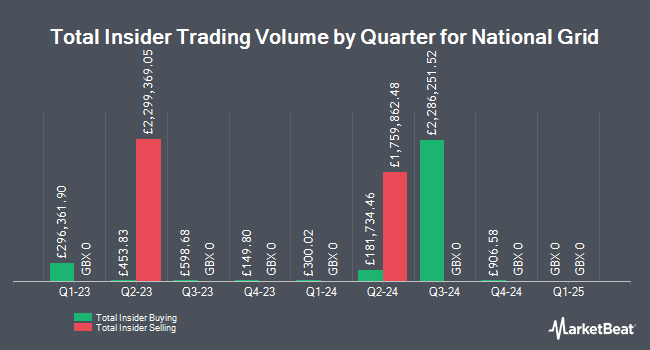

John Pettigrew also recently made the following trade(s):

- On Monday, October 7th, John Pettigrew bought 16 shares of National Grid stock. The shares were acquired at an average price of GBX 992 ($12.91) per share, for a total transaction of £158.72 ($206.61).

- On Tuesday, October 1st, John Pettigrew acquired 220,000 shares of National Grid stock. The shares were bought at an average cost of GBX 1,039 ($13.53) per share, for a total transaction of £2,285,800 ($2,975,527.21).

- On Monday, September 9th, John Pettigrew acquired 14 shares of National Grid stock. The stock was bought at an average cost of GBX 1,028 ($13.38) per share, with a total value of £143.92 ($187.35).

National Grid Stock Down 0.6 %

LON:NG opened at GBX 975.80 ($12.70) on Friday. The company has a market cap of £47.72 billion, a price-to-earnings ratio of 1,785.45, a price-to-earnings-growth ratio of 2.06 and a beta of 0.25. National Grid plc has a twelve month low of GBX 645 ($8.40) and a twelve month high of GBX 1,145.50 ($14.91). The company has a current ratio of 0.91, a quick ratio of 0.34 and a debt-to-equity ratio of 161.24. The stock has a fifty day simple moving average of GBX 1,015.33 and a 200-day simple moving average of GBX 986.92.

National Grid Cuts Dividend

JD Vance Predicts: Wall Street vs. Trump & Your Money

From Priority Gold | Ad

Trump's back in the White House, but Wall Street is pissed.

Here's the deal: Wall Street's about to purposely crash the bond market to sabotage Trump's comeback.

Get your free guide NOW before it's too late.

The business also recently disclosed a dividend, which will be paid on Tuesday, January 14th. Shareholders of record on Thursday, November 21st will be given a GBX 15.84 ($0.21) dividend. The ex-dividend date is Thursday, November 21st. This represents a yield of 1.61%. National Grid's dividend payout ratio (DPR) is 10,363.64%.

Analyst Upgrades and Downgrades

A number of brokerages recently issued reports on NG. Berenberg Bank lowered their price target on National Grid from GBX 1,150 ($14.97) to GBX 1,070 ($13.93) and set a "hold" rating for the company in a research report on Monday, October 14th. Citigroup restated a "top pick" rating on shares of National Grid in a report on Monday, September 16th. Finally, JPMorgan Chase & Co. reiterated an "overweight" rating and set a GBX 1,200 ($15.62) price target on shares of National Grid in a report on Friday, August 30th. One investment analyst has rated the stock with a hold rating, three have given a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Buy" and an average target price of GBX 1,181.25 ($15.38).

Read Our Latest Report on NG

National Grid Company Profile

(

Get Free Report)

National Grid plc transmits and distributes electricity and gas. It operates through UK Electricity Transmission, UK Electricity Distribution, UK Electricity System Operator, New England, New York, National Grid Ventures, and Other segments. The UK Electricity Transmission segment provides electricity transmission and construction work services in England and Wales.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].