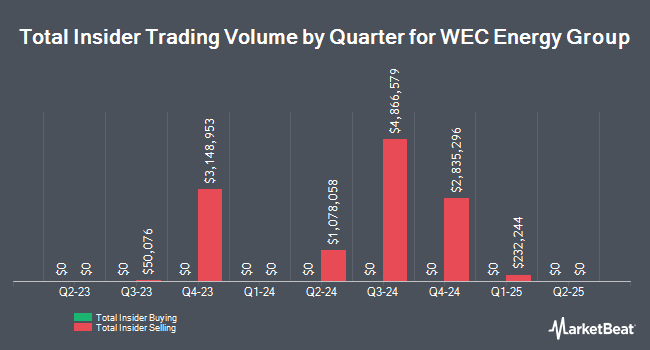

WEC Energy Group, Inc. (NYSE:WEC - Get Free Report) Director Gale E. Klappa sold 40,269 shares of the company's stock in a transaction that occurred on Thursday, November 21st. The shares were sold at an average price of $99.56, for a total value of $4,009,181.64. Following the completion of the transaction, the director now directly owns 273,248 shares in the company, valued at $27,204,570.88. The trade was a 12.84 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through the SEC website.

WEC Energy Group, Inc. (NYSE:WEC - Get Free Report) Director Gale E. Klappa sold 40,269 shares of the company's stock in a transaction that occurred on Thursday, November 21st. The shares were sold at an average price of $99.56, for a total value of $4,009,181.64. Following the completion of the transaction, the director now directly owns 273,248 shares in the company, valued at $27,204,570.88. The trade was a 12.84 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through the SEC website.

WEC Energy Group Stock Down 0.3 %

WEC stock opened at $100.66 on Friday. WEC Energy Group, Inc. has a 12 month low of $75.13 and a 12 month high of $101.43. The company has a current ratio of 0.65, a quick ratio of 0.46 and a debt-to-equity ratio of 1.37. The stock has a market capitalization of $31.84 billion, a P/E ratio of 24.61, a price-to-earnings-growth ratio of 2.74 and a beta of 0.44. The firm has a 50-day moving average price of $96.69 and a 200-day moving average price of $88.85.

WEC Energy Group (NYSE:WEC - Get Free Report) last issued its earnings results on Thursday, October 31st. The utilities provider reported $0.82 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.70 by $0.12. WEC Energy Group had a return on equity of 11.72% and a net margin of 15.14%. The business had revenue of $1.86 billion during the quarter, compared to analysts' expectations of $1.93 billion. During the same quarter in the prior year, the firm earned $1.00 EPS. The business's revenue for the quarter was down 4.8% compared to the same quarter last year. As a group, equities research analysts anticipate that WEC Energy Group, Inc. will post 4.87 EPS for the current fiscal year.

WEC Energy Group Announces Dividend

2024 Election Year Stocks: Uncover Hidden Gems!

From Darwin | Ad

In the lead-up to the pivotal 2024 election year, we're excited to present our comprehensive report, "Election Year Investment Gems: Stock Poised To Takeoff In 2024," brimming with insights and opportunities you won't want to miss.

Secure your copy now by clicking this link.

The firm also recently disclosed a quarterly dividend, which will be paid on Sunday, December 1st. Investors of record on Thursday, November 14th will be paid a $0.835 dividend. The ex-dividend date of this dividend is Thursday, November 14th. This represents a $3.34 annualized dividend and a dividend yield of 3.32%. WEC Energy Group's dividend payout ratio is 81.66%.

Wall Street Analyst Weigh In

A number of research firms have recently weighed in on WEC. Wells Fargo & Company lifted their target price on WEC Energy Group from $103.00 to $106.00 and gave the stock an "overweight" rating in a report on Wednesday, October 16th. Bank of America boosted their price objective on shares of WEC Energy Group from $88.00 to $90.00 and gave the company an "underperform" rating in a report on Thursday, August 29th. Jefferies Financial Group initiated coverage on shares of WEC Energy Group in a research report on Thursday, September 19th. They issued a "hold" rating and a $102.00 price target for the company. Barclays increased their price target on WEC Energy Group from $86.00 to $89.00 and gave the stock an "underweight" rating in a research report on Monday, October 7th. Finally, BMO Capital Markets boosted their price target on WEC Energy Group from $91.00 to $93.00 and gave the company a "market perform" rating in a research note on Friday, August 23rd. Three investment analysts have rated the stock with a sell rating, five have issued a hold rating and four have given a buy rating to the company. According to data from MarketBeat, the company presently has a consensus rating of "Hold" and an average target price of $94.45.

Get Our Latest Report on WEC

Institutional Investors Weigh In On WEC Energy Group

Several institutional investors and hedge funds have recently made changes to their positions in the stock. Global X Japan Co. Ltd. boosted its holdings in WEC Energy Group by 58.1% in the second quarter. Global X Japan Co. Ltd. now owns 321 shares of the utilities provider's stock valued at $25,000 after acquiring an additional 118 shares during the last quarter. Olistico Wealth LLC bought a new stake in WEC Energy Group during the second quarter valued at $29,000. Coastline Trust Co acquired a new stake in WEC Energy Group during the 3rd quarter worth about $29,000. William B. Walkup & Associates Inc. acquired a new position in shares of WEC Energy Group in the 2nd quarter valued at about $31,000. Finally, Triad Wealth Partners LLC acquired a new position in shares of WEC Energy Group in the 2nd quarter valued at about $36,000. Institutional investors and hedge funds own 77.20% of the company's stock.

WEC Energy Group Company Profile

(

Get Free Report)

WEC Energy Group, Inc, through its subsidiaries, provides regulated natural gas and electricity, and renewable and nonregulated renewable energy services in the United States. It operates through Wisconsin, Illinois, Other States, Electric Transmission, and Non-Utility Energy Infrastructure segments.

Read More

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].