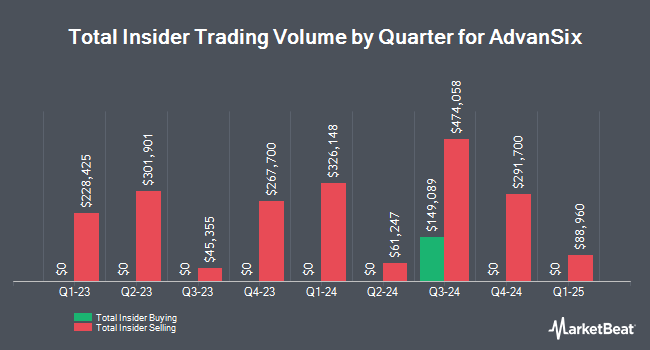

AdvanSix Inc. (NYSE:ASIX - Get Free Report) Director Donald P. Newman bought 5,030 shares of the stock in a transaction that occurred on Monday, November 18th. The shares were purchased at an average price of $29.64 per share, with a total value of $149,089.20. Following the completion of the acquisition, the director now directly owns 5,030 shares in the company, valued at $149,089.20. This trade represents a ∞ increase in their ownership of the stock. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website.

AdvanSix Inc. (NYSE:ASIX - Get Free Report) Director Donald P. Newman bought 5,030 shares of the stock in a transaction that occurred on Monday, November 18th. The shares were purchased at an average price of $29.64 per share, with a total value of $149,089.20. Following the completion of the acquisition, the director now directly owns 5,030 shares in the company, valued at $149,089.20. This trade represents a ∞ increase in their ownership of the stock. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website.

AdvanSix Stock Performance

NYSE:ASIX opened at $29.08 on Wednesday. AdvanSix Inc. has a fifty-two week low of $20.86 and a fifty-two week high of $32.04. The firm's 50 day moving average is $29.64 and its two-hundred day moving average is $26.87. The company has a market cap of $777.31 million, a P/E ratio of 20.62 and a beta of 1.69. The company has a quick ratio of 0.62, a current ratio of 1.34 and a debt-to-equity ratio of 0.28.

AdvanSix Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Tuesday, November 26th. Stockholders of record on Tuesday, November 12th will be given a $0.16 dividend. This represents a $0.64 annualized dividend and a dividend yield of 2.20%. The ex-dividend date of this dividend is Tuesday, November 12th. AdvanSix's payout ratio is 45.39%.

Analysts Set New Price Targets

[625,000% Gain] – Are You Ready for the Next Altcoin Boom?

From Crypto Swap Profits | Ad

All of our key indicators are flashing the same signal: an altcoin season is fast approaching.

And if you know anything about crypto, you know that altcoin seasons are where some of the biggest gains happen.

Register for the FREE Workshop Now & get $10 in Bitcoin

Several research analysts recently commented on the company. StockNews.com cut AdvanSix from a "buy" rating to a "hold" rating in a research note on Tuesday. Piper Sandler increased their price target on AdvanSix from $35.00 to $39.00 and gave the stock an "overweight" rating in a report on Friday, November 8th.

Check Out Our Latest Analysis on AdvanSix

Hedge Funds Weigh In On AdvanSix

Institutional investors have recently added to or reduced their stakes in the company. Copeland Capital Management LLC acquired a new position in AdvanSix in the third quarter worth about $41,000. Point72 DIFC Ltd bought a new stake in shares of AdvanSix during the second quarter valued at about $34,000. Acadian Asset Management LLC acquired a new stake in AdvanSix in the second quarter worth approximately $36,000. Point72 Asia Singapore Pte. Ltd. acquired a new stake in AdvanSix in the 2nd quarter valued at about $51,000. Finally, Allspring Global Investments Holdings LLC bought a new stake in shares of AdvanSix during the 2nd quarter worth $51,000. Institutional investors and hedge funds own 86.39% of the company's stock.

AdvanSix Company Profile

(

Get Free Report)

AdvanSix Inc engages in the manufacture and sale of polymer resins in the United States and internationally. It offers Nylon 6, a polymer resin, which is a synthetic material used to produce fibers, filaments, engineered plastics, and films. The company also provides caprolactam to manufacture polymer resins; ammonium sulfate fertilizers to distributors, farm cooperatives, and retailers; and acetone that are used in the production of adhesives, paints, coatings, solvents, herbicides, and engineered plastic resins, as well as other intermediate chemicals, including phenol, monoisopropylamine, dipropylamine, monoallylamine, alpha-methylstyrene, cyclohexanone, methyl ethyl ketoxime, acetaldehyde oxime, 2-pentanone oxime, cyclohexanol, sulfuric acid, ammonia, and carbon dioxide.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].